Instructions For Form 121a - Urban Redevelopment Excise Return - 2013

ADVERTISEMENT

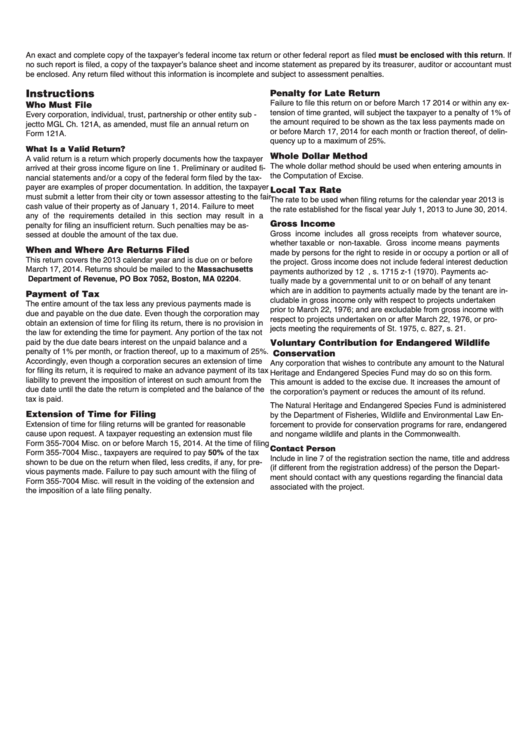

An exact and complete copy of the taxpayer’s federal income tax return or other federal report as filed must be enclosed with this return. If

no such report is filed, a copy of the taxpayer’s balance sheet and income statement as prepared by its treasurer, auditor or accountant must

be enclosed. Any return filed without this information is incomplete and subject to assessment penalties.

Failure to file this return on or before March 17 2014 or within any ex-

Instructions

Penalty for Late Return

tension of time granted, will subject the taxpayer to a penalty of 1% of

Every corporation, individual, trust, partnership or other entity sub-

Who Must File

the amount required to be shown as the tax less payments made on

ject to MGL Ch. 121A, as amended, must file an annual return on

or before March 17, 2014 for each month or fraction thereof, of delin-

Form 121A.

quency up to a maximum of 25%.

A valid return is a return which properly documents how the taxpayer

What Is a Valid Return?

The whole dollar method should be used when entering amounts in

arrived at their gross income figure on line 1. Preliminary or audited fi-

Whole Dollar Method

the Computation of Excise.

nancial statements and/or a copy of the federal form filed by the tax-

payer are examples of proper documentation. In addition, the taxpayer

must submit a letter from their city or town assessor attesting to the fair

The rate to be used when filing returns for the calendar year 2013 is

Local Tax Rate

cash value of their property as of January 1, 2014. Failure to meet

the rate established for the fiscal year July 1, 2013 to June 30, 2014.

any of the requirements detailed in this section may result in a

penalty for filing an insufficient return. Such penalties may be as-

Gross income includes all gross receipts from whatever source,

sessed at double the amount of the tax due.

Gross Income

whether taxable or non-taxable. Gross income means payments

made by persons for the right to reside in or occupy a portion or all of

This return covers the 2013 calendar year and is due on or before

When and Where

re Returns Filed

the project. Gross income does not include federal interest deduction

March 17, 2014. Returns should be mailed to the Massachusetts

payments authorized by 12 U.S.C., s. 1715 z-1 (1970). Payments ac-

Department of Revenue, PO Box 7052, Boston, MA 02204.

tually made by a governmental unit to or on behalf of any tenant

which are in addition to payments actually made by the tenant are in-

cludable in gross income only with respect to projects undertaken

The entire amount of the tax less any previous payments made is

Payment of Tax

prior to March 22, 1976; and are excludable from gross income with

due and payable on the due date. Even though the corporation may

respect to projects undertaken on or after March 22, 1976, or pro-

obtain an extension of time for filing its return, there is no provision in

jects meeting the requirements of St. 1975, c. 827, s. 21.

the law for extending the time for payment. Any portion of the tax not

paid by the due date bears interest on the unpaid balance and a

penalty of 1% per month, or fraction thereof, up to a maximum of 25%.

Voluntary Contribution for Endangered Wildlife

Accordingly, even though a corporation secures an extension of time

Any corporation that wishes to contribute any amount to the Natural

Conservation

for filing its return, it is required to make an advance payment of its tax

Heritage and Endangered Species Fund may do so on this form.

liability to prevent the imposition of interest on such amount from the

This amount is added to the excise due. It increases the amount of

due date until the date the return is completed and the balance of the

the corporation’s payment or reduces the amount of its refund.

tax is paid.

The Natural Heritage and Endangered Species Fund is administered

by the Department of Fisheries, Wildlife and Environmental Law En-

Extension of time for filing returns will be granted for reasonable

forcement to provide for conservation programs for rare, endangered

Extension of Time for Filing

cause upon request. A taxpayer requesting an extension must file

and nongame wildlife and plants in the Commonwealth.

Form 355-7004 Misc. on or before March 15, 2014. At the time of filing

Form 355-7004 Misc., taxpayers are required to pay 50% of the tax

Include in line 7 of the registration section the name, title and address

Contact Person

shown to be due on the return when filed, less credits, if any, for pre-

(if different from the registration address) of the person the Depart-

vious payments made. Failure to pay such amount with the filing of

ment should contact with any questions regarding the financial data

Form 355-7004 Misc. will result in the voiding of the extension and

associated with the project.

the imposition of a late filing penalty.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1