Financial Planning Information Page 2

Download a blank fillable Financial Planning Information in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Financial Planning Information with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

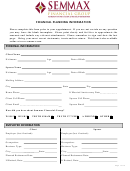

RISK ASSESSMENT QUESTIONNAIRE

The Risk Assessment Questionnaire helps to determine the best asset mix for a financial plan, based on the answers

given to the questions below. This page must be completed for compliance purposes.

(Please Only Check One Box For Each Question)

Time Horizon - Your current situation and future income needs.

1.

What is your current age?

2.

When do you expect to start withdrawing income?

Less than 45

Not for at least 20 years

45 to 55

In 10 to 20 years

56 to 65

In 5 to 10 years

66 to 75

Not now, but within 5 years

Older than 75

Immediately

Long-Term Goals and Expectations - Your views of how an investment should perform over the long term.

3.

What is your goal for this investment?

To grow aggressively

To grow with caution

To grow significantly

To avoid losing money

To grow moderately

4.

Assuming normal market conditions, what would you expect from this investment over time?

To generally keep pace with the stock market

To slightly trail the stock market, but make a good profit

To trail the stock markets, but make a moderate profit

To have some stability, but make modest profits

To have a high degree of stability, but make small profits

5.

Suppose the stock market performs unusually poorly over the next decade, what would you expect from this investment?

To lose money

To make a modest gain

To make very little or nothing

To be little affected by what happens in the

To make out a little gain

stock market

Short-Term Risk Attitude - Your attitude toward short-term volatility.

6.

Which of these statements would best describe your attitudes about the next three years' performance of this investment?

I don't mind if I lose money

I'd have a hard time tolerating any losses

I can tolerate a loss

I need to see at least some return

I can tolerate a small loss

7.

Which of these statements would best describe your attitudes about the next three months' performance of this investment?

Who cares? One calendar quarter means nothing

I wouldn't worry about losses in that time frame.

If I suffered a loss of greater than 10% I'd get concerned.

I can only tolerate small short-term losses.

I'd have a hard time stomaching any losses.

Page 2 of 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10