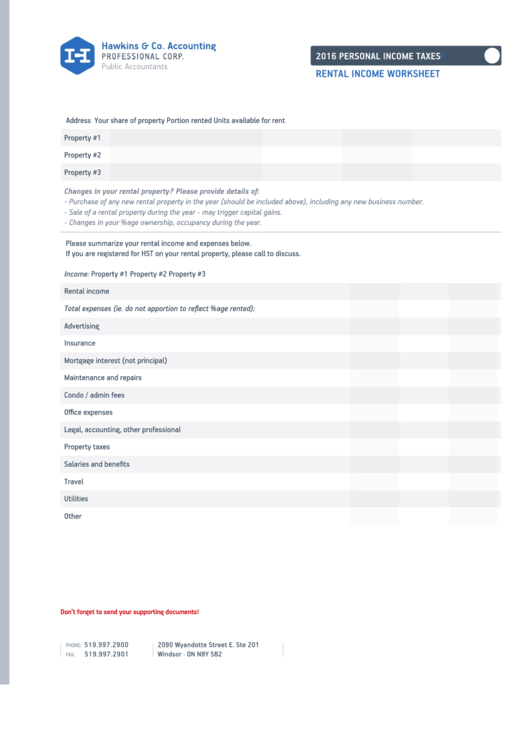

Rental Income Worksheet

ADVERTISEMENT

2016 PERSONAL INCOME TAXES

1/1

RENTAL INCOME WORKSHEET

Address

Your share of property

Portion rented

Units available for rent

Property #1

Property #2

Property #3

Changes in your rental property? Please provide details of:

- Purchase of any new rental property in the year (should be included above), including any new business number.

- Sale of a rental property during the year - may trigger capital gains.

- Changes in your %age ownership, occupancy during the year.

Please summarize your rental income and expenses below.

If you are registered for HST on your rental property, please call to discuss.

Income:

Property #1

Property #2

Property #3

Rental income

Total expenses (ie. do not apportion to reflect %age rented):

Advertising

Insurance

Mortgage interest (not principal)

Maintenance and repairs

Condo / admin fees

Office expenses

Legal, accounting, other professional

Property taxes

Salaries and benefits

Travel

Utilities

Other

Don’t forget to send your supporting documents!

519.997.2900

2090 Wyandotte Street E. Ste 201

info@hawkins-accounting.ca

PHONE:

519.997.2901

Windsor · ON N8Y 5B2

FAX:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1