PRINT

CLEAR

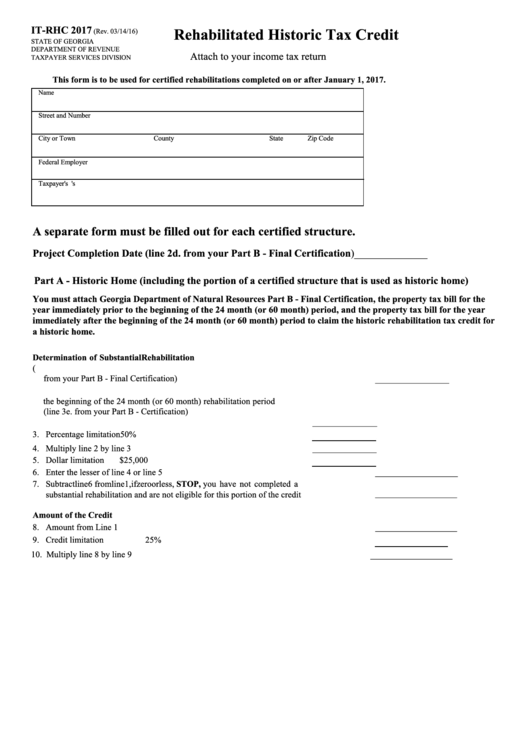

IT-RHC 2017

Rehabilitated Historic Tax Credit

(Rev. 03/14/16)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

Attach to your income tax return

TAXPAYER SERVICES DIVISION

This form is to be used for certified rehabilitations completed on or after January 1, 2017.

Name

Street and Number

City or Town

County

State

Zip Code

Federal Employer I.D. No.

Taxpayer's S.S. Number

Spouse's S.S. Number

A separate form must be filled out for each certified structure.

Project Completion Date (line 2d. from your Part B - Final Certification)______________

Part A - Historic Home (including the portion of a certified structure that is used as historic home)

You must attach Georgia Department of Natural Resources Part B - Final Certification, the property tax bill for the

year immediately prior to the beginning of the 24 month (or 60 month) period, and the property tax bill for the year

immediately after the beginning of the 24 month (or 60 month) period to claim the historic rehabilitation tax credit for

a historic home.

Determination of Substantial Rehabilitation

1. Amount of the qualified rehabilitation expenditures (line 2e. II.

from your Part B - Final Certification)

___________

2. Fair market value as determined by the county tax assessor at

the beginning of the 24 month (or 60 month) rehabilitation period

(line 3e. from your Part B - Certification)

______________

3. Percentage limitation

50%

4. Multiply line 2 by line 3

______________

5. Dollar limitation

$25,000

6. Enter the lesser of line 4 or line 5

___________

7. Subtract line 6 from line 1, if zero or less, STOP, you have not completed a

substantial rehabilitation and are not eligible for this portion of the credit

___________

Amount of the Credit

_____________

8. Amount from Line 1

9. Credit limitation

25%

_____________

10. Multiply line 8 by line 9

1

1 2

2 3

3