Form Mo-1040v - Individual Income Tax Payment Voucher - 2001

ADVERTISEMENT

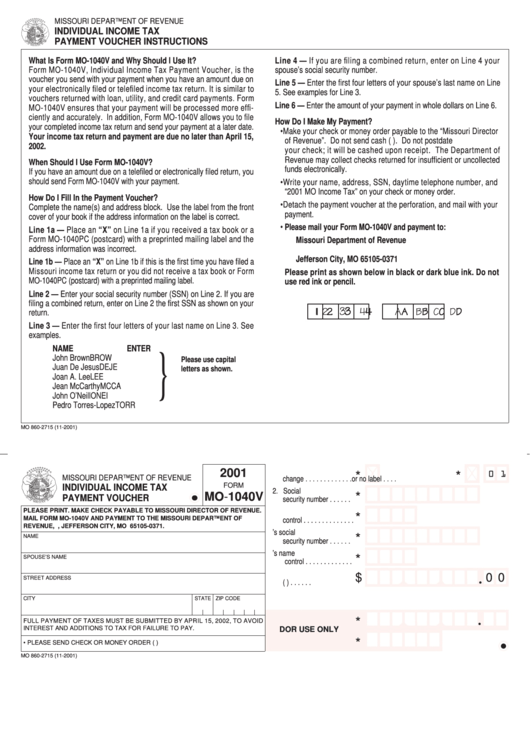

MISSOURI DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX

PAYMENT VOUCHER INSTRUCTIONS

What Is Form MO-1040V and Why Should I Use It?

Line 4 — If you are filing a combined return, enter on Line 4 your

Form MO-1040V, Individual Income Tax Payment Voucher, is the

spouse’s social security number.

voucher you send with your payment when you have an amount due on

Line 5 — Enter the first four letters of your spouse’s last name on Line

your electronically filed or telefiled income tax return. It is similar to

5. See examples for Line 3.

vouchers returned with loan, utility, and credit card payments. Form

Line 6 — Enter the amount of your payment in whole dollars on Line 6.

MO-1040V ensures that your payment will be processed more effi-

ciently and accurately. In addition, Form MO-1040V allows you to file

How Do I Make My Payment?

your completed income tax return and send your payment at a later date.

• Make your check or money order payable to the “Missouri Director

Your income tax return and payment are due no later than April 15,

of Revenue”. Do not send cash (U.S. funds only). Do not postdate

2002.

your check; it will be cashed upon receipt. The Department of

Revenue may collect checks returned for insufficient or uncollected

When Should I Use Form MO-1040V?

funds electronically.

If you have an amount due on a telefiled or electronically filed return, you

should send Form MO-1040V with your payment.

• Write your name, address, SSN, daytime telephone number, and

“2001 MO Income Tax” on your check or money order.

How Do I Fill In the Payment Voucher?

• Detach the payment voucher at the perforation, and mail with your

Complete the name(s) and address block. Use the label from the front

payment.

cover of your book if the address information on the label is correct.

• Please mail your Form MO-1040V and payment to:

Line 1a — Place an “X” on Line 1a if you received a tax book or a

Form MO-1040PC (postcard) with a preprinted mailing label and the

Missouri Department of Revenue

address information was incorrect.

P.O. Box 371

Jefferson City, MO 65105-0371

Line 1b — Place an “X” on Line 1b if this is the first time you have filed a

Missouri income tax return or you did not receive a tax book or Form

Please print as shown below in black or dark blue ink. Do not

MO-1040PC (postcard) with a preprinted mailing label.

use red ink or pencil.

Line 2 — Enter your social security number (SSN) on Line 2. If you are

filing a combined return, enter on Line 2 the first SSN as shown on your

1 1

2 2

3 3 4 4

A A B B C C D D

return.

Line 3 — Enter the first four letters of your last name on Line 3. See

examples.

NAME

ENTER

}

John Brown

BROW

Please use capital

Juan De Jesus

DEJE

letters as shown.

Joan A. Lee

LEE

Jean McCarthy

MCCA

John O’Neill

ONEI

Pedro Torres-Lopez

TORR

MO 860-2715 (11-2001)

1a. Address

1b. First time filer

2001

0 1

*

*

MISSOURI DEPARTMENT OF REVENUE

change . . . . . . . . . . . . .

or no label . . . .

FORM

INDIVIDUAL INCOME TAX

2. Social

*

MO-1040V

PAYMENT VOUCHER

security number . . . . . .

PLEASE PRINT. MAKE CHECK PAYABLE TO MISSOURI DIRECTOR OF REVENUE.

3. Name

*

MAIL FORM MO-1040V AND PAYMENT TO THE MISSOURI DEPARTMENT OF

control . . . . . . . . . . . . . .

REVENUE, P.O. BOX 371, JEFFERSON CITY, MO 65105-0371.

4. Spouse’s social

*

NAME

security number . . . . . .

5. Spouse’s name

*

SPOUSE’S NAME

control . . . . . . . . . . . . .

6. Amount of payment

$

0 0

STREET ADDRESS

(U.S. funds only) . . . . . .

•

CITY

STATE ZIP CODE

*

FULL PAYMENT OF TAXES MUST BE SUBMITTED BY APRIL 15, 2002, TO AVOID

•

INTEREST AND ADDITIONS TO TAX FOR FAILURE TO PAY.

DOR USE ONLY

*

• PLEASE SEND CHECK OR MONEY ORDER (U.S. FUNDS ONLY)

MO 860-2715 (11-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1