Publication 505 - Tax Withholding And Estimated Tax Page 40

ADVERTISEMENT

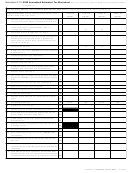

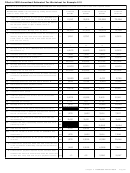

Table 4-1. Calendar to Determine Number of Days a Payment is Late

Instructions. First, find the number for the payment due date. Then, find the number for the date the payment was made. Finally, subtract

the payment due date number from the payment date number. The answer is the number of days the payment is late.

Example. The payment due date is June 15 (61). The payment was made on November 4 (203). The payment is 142 days late (203 - 61).

Tax Year 2001

Day of

2001

2001

2001

2001

2001

2001

2001

2001

2001

2002

2002

2002

2002

Month

April

May

June

July

Aug.

Sept.

Oct.

Nov.

Dec.

Jan.

Feb.

March

April

1

16

47

77

108

139

169

200

230

261

292

320

351

2

17

48

78

109

140

170

201

231

262

293

321

352

3

18

49

79

110

141

171

202

232

263

294

322

353

4

19

50

80

111

142

172

203

233

264

295

323

354

5

20

51

81

112

143

173

204

234

265

296

324

355

6

21

52

82

113

144

174

205

235

266

297

325

356

7

22

53

83

114

145

175

206

236

267

298

326

357

8

23

54

84

115

146

176

207

237

268

299

327

358

9

24

55

85

116

147

177

208

238

269

300

328

359

10

25

56

86

117

148

178

209

239

270

301

329

360

11

26

57

87

118

149

179

210

240

271

302

330

361

12

27

58

88

119

150

180

211

241

272

303

331

362

13

28

59

89

120

151

181

212

242

273

304

332

363

14

29

60

90

121

152

182

213

243

274

305

333

364

15

0

30

61

91

122

153

183

214

244

275

306

334

365

16

1

31

62

92

123

154

184

215

245

276

307

335

17

2

32

63

93

124

155

185

216

246

277

308

336

18

3

33

64

94

125

156

186

217

247

278

309

337

19

4

34

65

95

126

157

187

218

248

279

310

338

20

5

35

66

96

127

158

188

219

249

280

311

339

21

6

36

67

97

128

159

189

220

250

281

312

340

22

7

37

68

98

129

160

190

221

251

282

313

341

23

8

38

69

99

130

161

191

222

252

283

314

342

24

9

39

70

100

131

162

192

223

253

284

315

343

25

10

40

71

101

132

163

193

224

254

285

316

344

26

11

41

72

102

133

164

194

225

255

286

317

345

27

12

42

73

103

134

165

195

226

256

287

318

346

28

13

43

74

104

135

166

196

227

257

288

319

347

29

14

44

75

105

136

167

197

228

258

289

348

30

15

45

76

106

137

168

198

229

259

290

349

31

46

107

138

199

260

291

350

Annualized Income Installment

If you use your actual withholding, you must

($6,116), Ben knows he owes a penalty for un-

check the box on line 1c, Part I of Form 2210 and

Method (Schedule AI)

derpayment of estimated tax. He decides to fig-

complete Form 2210 and file it with your return.

ure the penalty on Form 2210 and pay it with his

If you did not receive your income evenly

$1,803 tax balance ($7,031 − $5,228) when he

throughout the year (for example, your income

files his tax return on April 15, 2002.

Regular Installment Method

from a repair shop you operated was much

Ben’s required annual payment (Part II, line

larger in the summer than it was during the rest

The filled-in form for the following example is

14) is $6,116. Because his income and withhold-

of the year), you may be able to lower or elimi-

shown at the end of this chapter.

ing were distributed evenly throughout the year,

nate your penalty by figuring your underpayment

Ben enters one-fourth of his required annual

using the annualized income installment

Example 4.6. Ben Brown’s 2001 total tax

method. Under this method, your required in-

payment, $1,529, in each column of line 22. On

(Form 1040, line 58) is $7,031, the total of his

stallment (line 22) for one or more payment

line 23, he enters one-fourth of his withholding,

$4,685 income tax and $2,346 self-employment

periods may be less than one-fourth of your

$807 in the first two columns and $1,807 ($807

tax. (His 2000 AGI was less than $150,000.) He

required annual payment.

plus $1,000 estimated tax payment) in the last

does not owe any other taxes or claim any cred-

To figure your underpayment using this

two columns.

its other than for withholding. His 2000 tax was

method, complete Schedule AI of Form 2210.

$6,116.

Ben has an underpayment (line 29) for each

The schedule annualizes your tax at the end of

Ben’s employer withheld $3,228 income tax

payment period even though his withholding and

each payment period based on your income,

during 2001. Ben made no estimated tax pay-

estimated tax payments for the third and fourth

deductions, and other items relating to events

ment for either the first or second period, but he

periods were more than his required install-

that occurred since the beginning of the tax year

paid $1,000 each on September 2, 2001, and

ments (line 22). This is because the estimated

through the end of the period.

January 12, 2002, for the third and fourth peri-

tax payments made in the third and fourth peri-

If you use the annualized income installment

ods. Because the total of his withholding and

ods are first applied to underpayments for the

method, you must check the box on line 1b of

estimated tax payments, $5,228 ($3,228 +

earlier periods. Part IV, Section A, of Ben’s Form

$1,000 + $1,000), was less than 90% of his 2001

Form 2210. You also must attach Form 2210

tax ($6,328), and was also less than his 2000 tax

2210 is shown at the end of this chapter.

and Schedule AI to your return.

Page 40

Chapter 4 Underpayment Penalty for 2001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49