Form It-2104 - Employee'S Withholding Allowance Certificate

ADVERTISEMENT

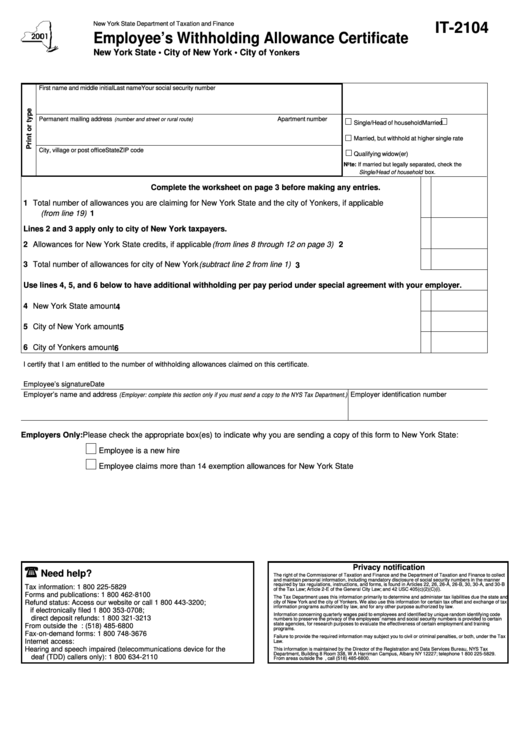

New York State Department of Taxation and Finance

IT-2104

Employee’s Withholding Allowance Certificate

New York State • City of New York • City of

Yonkers

First name and middle initial

Last name

Your social security number

Permanent mailing address

Apartment number

(number and street or rural route)

Single/Head of household

Married

Married, but withhold at higher single rate

City, village or post office

State

ZIP code

Qualifying widow(er)

Note: If married but legally separated, check the

Single/Head of household box.

Complete the worksheet on page 3 before making any entries.

1 Total number of allowances you are claiming for New York State and the city of Yonkers, if applicable

(from line 19) ........................................................................................................................................................ 1

Lines 2 and 3 apply only to city of New York taxpayers.

2 Allowances for New York State credits, if applicable (from lines 8 through 12 on page 3) ..................................... 2

3 Total number of allowances for city of New York (subtract line 2 from line 1) ......................................................... 3

Use lines 4, 5, and 6 below to have additional withholding per pay period under special agreement with your employer.

4 New York State amount ............................................................................................................................................ 4

5 City of New York amount .......................................................................................................................................... 5

6 City of Yonkers amount ............................................................................................................................................ 6

I certify that I am entitled to the number of withholding allowances claimed on this certificate.

Employee’s signature

Date

Employer’s name and address

Employer identification number

(Employer: complete this section only if you must send a copy to the NYS Tax Department.)

Employers Only: Please check the appropriate box(es) to indicate why you are sending a copy of this form to New York State:

Employee is a new hire

Employee claims more than 14 exemption allowances for New York State

Privacy notification

Need help?

The right of the Commissioner of Taxation and Finance and the Department of Taxation and Finance to collect

and maintain personal information, including mandatory disclosure of social security numbers in the manner

required by tax regulations, instructions, and forms, is found in Articles 22, 26, 26-A, 26-B, 30, 30-A, and 30-B

Tax information: 1 800 225-5829

of the Tax Law; Article 2-E of the General City Law; and 42 USC 405(c)(2)(C)(i).

Forms and publications: 1 800 462-8100

The Tax Department uses this information primarily to determine and administer tax liabilities due the state and

Refund status: Access our website or call 1 800 443-3200;

city of New York and the city of Yonkers. We also use this information for certain tax offset and exchange of tax

information programs authorized by law, and for any other purpose authorized by law.

if electronically filed 1 800 353-0708;

Information concerning quarterly wages paid to employees and identified by unique random identifying code

direct deposit refunds: 1 800 321-3213

numbers to preserve the privacy of the employees’ names and social security numbers is provided to certain

state agencies, for research purposes to evaluate the effectiveness of certain employment and training

From outside the U.S. and outside Canada: (518) 485-6800

programs.

Fax-on-demand forms: 1 800 748-3676

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax

Internet access:

Law.

Hearing and speech impaired (telecommunications device for the

This information is maintained by the Director of the Registration and Data Services Bureau, NYS Tax

Department, Building 8 Room 338, W A Harriman Campus, Albany NY 12227; telephone 1 800 225-5829.

deaf (TDD) callers only): 1 800 634-2110

From areas outside the U.S. and outside Canada, call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3