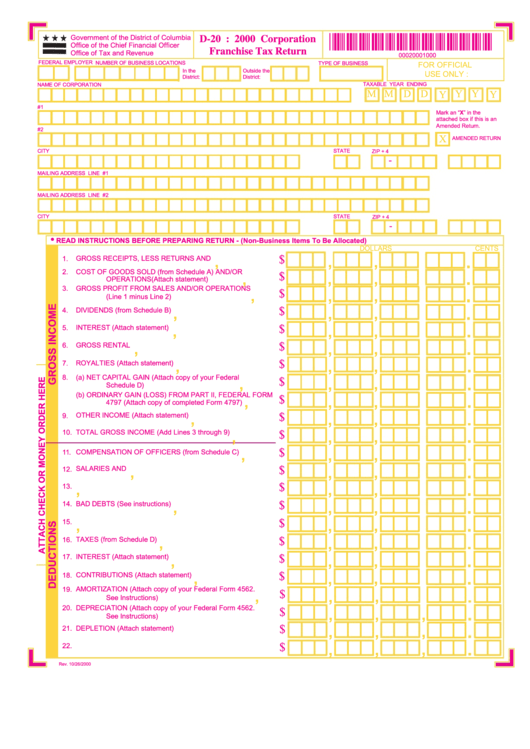

Form D-20 - 2000 Corporation Franchise Tax Return - District Of Columbia Office Of Tax And Revenue

ADVERTISEMENT

*00020001000*

Government of the District of Columbia

D-20 : 2000 Corporation

Office of the Chief Financial Officer

Franchise Tax Return

Office of Tax and Revenue

00020001000

FEDERAL EMPLOYER I.D. NUMBER

NUMBER OF BUSINESS LOCATIONS

TYPE OF BUSINESS

FOR OFFICIAL

In the

Outside the

USE ONLY :

District:

District:

NAME OF CORPORATION

TAXABLE YEAR ENDING

M M

D D

Y

Y

Y

Y

D.C. ADDRESS LINE #1

Mark an “X” in the

attached box if this is an

Amended Return.

D.C. ADDRESS LINE #2

X

AMENDED RETURN

STATE

CITY

ZIP + 4

-

MAILING ADDRESS LINE #1

MAILING ADDRESS LINE #2

CITY

STATE

ZIP + 4

-

•

READ INSTRUCTIONS BEFORE PREPARING RETURN - (Non-Business Items To Be Allocated)

DOLLARS

CENTS

$

1.

GROSS RECEIPTS, LESS RETURNS AND ALLOWANCES.........

,

,

,

2.

COST OF GOODS SOLD (from Schedule A) AND/OR

$

,

,

,

OPERATIONS(Attach statement)....................................

3.

GROSS PROFIT FROM SALES AND/OR OPERATIONS

$

,

,

,

(Line 1 minus Line 2).......................................................

$

4.

DIVIDENDS (from Schedule B).......................................................

,

,

,

$

5.

INTEREST (Attach statement) .......................................................

,

,

,

$

6.

GROSS RENTAL INCOME.............................................................

,

,

,

$

7.

ROYALTIES (Attach statement)......................................................

,

,

,

8.

(a) NET CAPITAL GAIN (Attach copy of your Federal

$

,

,

,

Schedule D).....................................................................

(b) ORDINARY GAIN (LOSS) FROM PART II, FEDERAL FORM

$

,

,

,

4797 (Attach copy of completed Form 4797)...................

$

9.

OTHER INCOME (Attach statement)..............................................

,

,

,

10.

TOTAL GROSS INCOME (Add Lines 3 through 9)..........................

$

,

,

,

$

11.

COMPENSATION OF OFFICERS (from Schedule C)....................

,

,

,

$

12.

SALARIES AND WAGES................................................................

,

,

,

$

13.

REPAIRS.........................................................................................

,

,

,

$

14.

BAD DEBTS (See instructions).......................................................

,

,

,

$

15.

RENT...............................................................................................

,

,

,

$

16.

TAXES (from Schedule D)...............................................................

,

,

,

17.

INTEREST (Attach statement)........................................................

$

,

,

,

$

18.

CONTRIBUTIONS (Attach statement).............................................

,

,

,

19.

AMORTIZATION (Attach copy of your Federal Form 4562.

$

,

,

,

See Instructions)..............................................................

20.

DEPRECIATION (Attach copy of your Federal Form 4562.

$

,

,

,

See Instructions)..............................................................

$

21.

DEPLETION (Attach statement)......................................................

,

,

,

$

22.

ADVERTISING................................................................................

,

,

,

Rev. 10/26/2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5