Monthly Budget Worksheet Template

ADVERTISEMENT

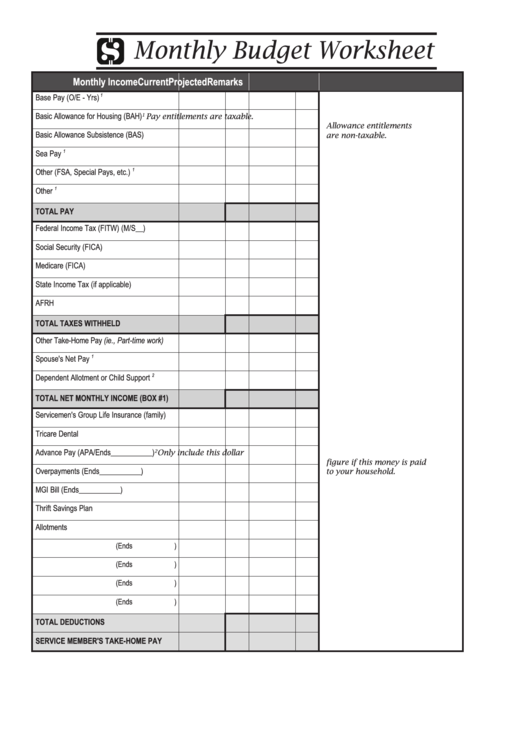

Monthly Budget Worksheet

Monthly Income

Current

Projected

Remarks

Base Pay (O/E - Yrs)

1

Basic Allowance for Housing (BAH)

Pay entitlements are taxable.

1

Allowance entitlements

Basic Allowance Subsistence (BAS)

are non-taxable.

Sea Pay

1

Other (FSA, Special Pays, etc.)

1

Other

1

TOTAL PAY

Federal Income Tax (FITW) (M/S__)

Social Security (FICA)

Medicare (FICA)

State Income Tax (if applicable)

AFRH

TOTAL TAXES WITHHELD

Other Take-Home Pay (ie., Part-time work)

Spouse's Net Pay

1

Dependent Allotment or Child Support

2

TOTAL NET MONTHLY INCOME (BOX #1)

Servicemen's Group Life Insurance (family)

Tricare Dental

Advance Pay (APA/Ends___________)

2

Only include this dollar

figure if this money is paid

Overpayments (Ends___________)

to your household.

MGI Bill (Ends___________)

Thrift Savings Plan

Allotments

(Ends

)

(Ends

)

(Ends

)

(Ends

)

TOTAL DEDUCTIONS

SERvICE MEMBER'S TAkE-HOME PAY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2