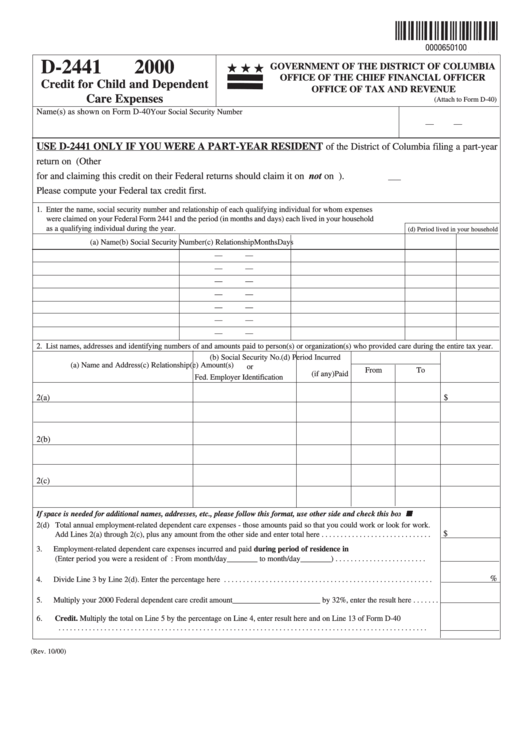

Form D-2441 - Credit For Child And Dependent Care Expenses - 2000

ADVERTISEMENT

0000650100

D-2441

2000

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF THE CHIEF FINANCIAL OFFICER

Credit for Child and Dependent

OFFICE OF TAX AND REVENUE

Care Expenses

(Attach to Form D-40)

Name(s) as shown on Form D-40

Your Social Security Number

—

—

USE D-2441 ONLY IF YOU WERE A PART-YEAR RESIDENT

of the District of Columbia filing a part-year

return on D.C. Form D-40 and eligible for and claiming this credit on your Federal return. (Other D.C. residents eligible

for and claiming this credit on their Federal returns should claim it on D.C. Form D-40 and not on D.C. Form D-2441).

Please compute your Federal tax credit first.

1. Enter the name, social security number and relationship of each qualifying individual for whom expenses

were claimed on your Federal Form 2441 and the period (in months and days) each lived in your household

as a qualifying individual during the year.

(d) Period lived in your household

(a) Name

(b) Social Security Number

(c) Relationship

Months

Days

—

—

—

—

—

—

—

—

—

—

—

—

—

—

2. List names, addresses and identifying numbers of and amounts paid to person(s) or organization(s) who provided care during the entire tax year.

(b) Social Security No.

(d) Period Incurred

(a) Name and Address

(c) Relationship

(e) Amount(s)

or

From

To

(if any)

Paid

Fed. Employer Identification No.

Month/Day

Month/Day

2(a)

$

2(b)

2(c)

If space is needed for additional names, addresses, etc., please follow this format, use other side and check this box

.

2(d) Total annual employment-related dependent care expenses - those amounts paid so that you could work or look for work.

$

Add Lines 2(a) through 2(c), plus any amount from the other side and enter total here . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Employment-related dependent care expenses incurred and paid during period of residence in D.C.

(Enter period you were a resident of D.C.: From month/day________ to month/day________) . . . . . . . . . . . . . . . . . . . . . . . .

%

4.

Divide Line 3 by Line 2(d). Enter the percentage here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Multiply your 2000 Federal dependent care credit amount_______________________ by 32%, enter the result here . . . . . . .

6.

Credit. Multiply the total on Line 5 by the percentage on Line 4, enter result here and on Line 13 of Form D-40

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Rev. 10/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1