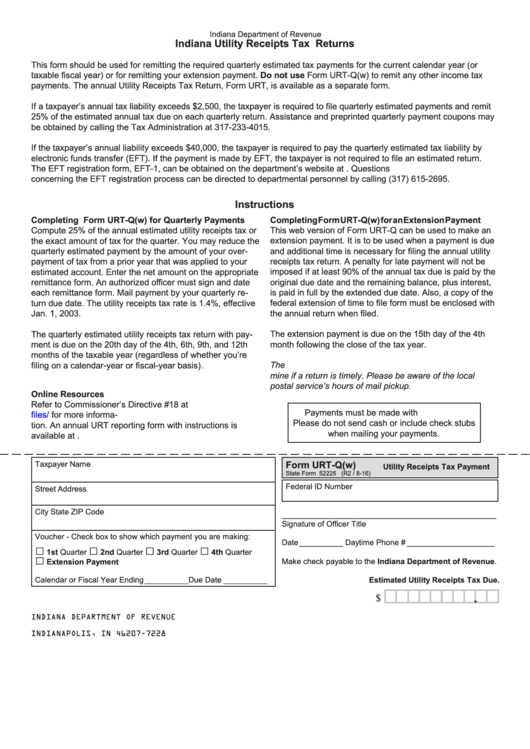

Indiana Department of Revenue

Indiana Utility Receipts Tax Returns

This form should be used for remitting the required quarterly estimated tax payments for the current calendar year (or

taxable fiscal year) or for remitting your extension payment. Do not use Form URT-Q(w) to remit any other income tax

payments. The annual Utility Receipts Tax Return, Form URT, is available as a separate form.

If a taxpayer’s annual tax liability exceeds $2,500, the taxpayer is required to file quarterly estimated payments and remit

25% of the estimated annual tax due on each quarterly return. Assistance and preprinted quarterly payment coupons may

be obtained by calling the Tax Administration at 317-233-4015.

If the taxpayer’s annual liability exceeds $40,000, the taxpayer is required to pay the quarterly estimated tax liability by

electronic funds transfer (EFT). If the payment is made by EFT, the taxpayer is not required to file an estimated return.

The EFT registration form, EFT-1, can be obtained on the department’s website at

Questions

concerning the EFT registration process can be directed to departmental personnel by calling (317) 615-2695.

Instructions

Completing Form URT-Q(w) for an Extension Payment

Completing Form URT-Q(w) for Quarterly Payments

This web version of Form URT-Q can be used to make an

Compute 25% of the annual estimated utility receipts tax or

the exact amount of tax for the quarter. You may reduce the

extension payment. It is to be used when a payment is due

quarterly estimated payment by the amount of your over-

and additional time is necessary for filing the annual utility

receipts tax return. A penalty for late payment will not be

payment of tax from a prior year that was applied to your

estimated account. Enter the net amount on the appropriate

imposed if at least 90% of the annual tax due is paid by the

remittance form. An authorized officer must sign and date

original due date and the remaining balance, plus interest,

is paid in full by the extended due date. Also, a copy of the

each remittance form. Mail payment by your quarterly re-

turn due date. The utility receipts tax rate is 1.4%, effective

federal extension of time to file form must be enclosed with

the annual return when filed.

Jan. 1, 2003.

The quarterly estimated utility receipts tax return with pay-

The extension payment is due on the 15th day of the 4th

month following the close of the tax year.

ment is due on the 20th day of the 4th, 6th, 9th, and 12th

months of the taxable year (regardless of whether you’re

filing on a calendar-year or fiscal-year basis).

The U.S. Postal Service postmark date is used to deter-

mine if a return is timely. Please be aware of the local

postal service’s hours of mail pickup.

Online Resources

Refer to Commissioner’s Directive #18 at

Payments must be made with U.S. funds.

for more informa-

Please do not send cash or include check stubs

tion. An annual URT reporting form with instructions is

when mailing your payments.

available at

Form URT-Q(w)

Taxpayer Name

Utility Receipts Tax Payment

State Form 52225 (R2 / 8-16)

Federal ID Number

Street Address

City

State

ZIP Code

_________________________________________________

Signature of Officer

Title

Voucher - Check box to show which payment you are making:

Date __________ Daytime Phone # ____________________

□

□

□

□

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

□

Make check payable to the Indiana Department of Revenue.

Extension Payment

Calendar or Fiscal Year Ending __________ Due Date __________

Estimated Utility Receipts Tax Due.

.

$

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 7228

INDIANAPOLIS, IN 46207-7228

1

1