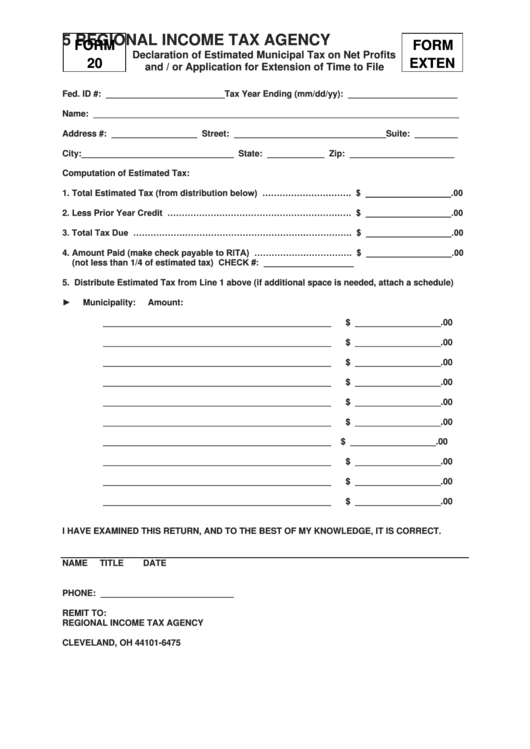

Form 20 - Declaration Of Estimated Municipal Tax On Net Profits And / Or Application For Extension Of Time To File

ADVERTISEMENT

5

REGIONAL INCOME TAX AGENCY

FORM

FORM

Declaration of Estimated Municipal Tax on Net Profits

20

EXTEN

and / or Application for Extension of Time to File

Fed. ID #: _________________________ Tax Year Ending (mm/dd/yy): _______________________

Name: _____________________________________________________________________________

Address #: __________________ Street: ________________________________ Suite: _________

City: ________________________________ State: ____________ Zip: ______________________

Computation of Estimated Tax:

1. Total Estimated Tax (from distribution below) …………………………. $ __________________.00

2. Less Prior Year Credit ………………………………………………………. $ __________________.00

3. Total Tax Due …………………………………………………………………. $ __________________.00

4. Amount Paid (make check payable to RITA) ……………………………. $ __________________.00

(not less than 1/4 of estimated tax) CHECK #: ___________________

5. Distribute Estimated Tax from Line 1 above (if additional space is needed, attach a schedule)

►

Municipality:

Amount:

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

________________________________________________

$ __________________.00

I HAVE EXAMINED THIS RETURN, AND TO THE BEST OF MY KNOWLEDGE, IT IS CORRECT.

NAME

TITLE

DATE

PHONE: ____________________________

REMIT TO:

REGIONAL INCOME TAX AGENCY

P.O. BOX 89475

CLEVELAND, OH 44101-6475

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2