Instructions For Form De 26 - Vendor (Third Party) New Enrollment Request

ADVERTISEMENT

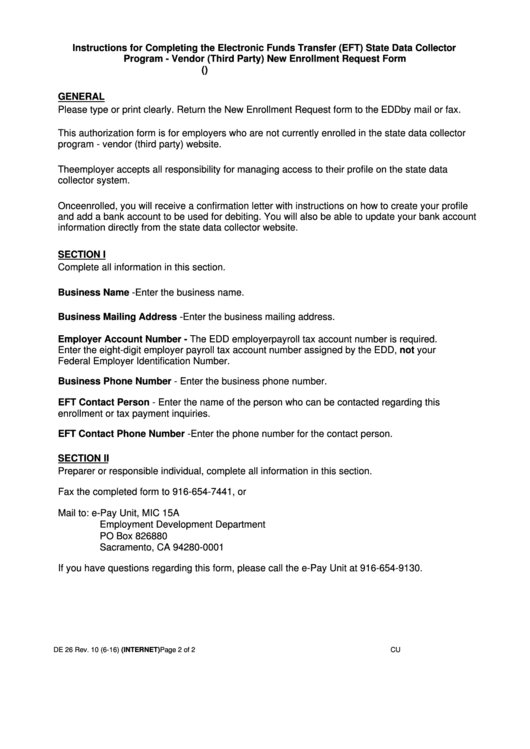

Instructions for Completing the Electronic Funds Transfer (EFT) State Data Collector

Program - Vendor (Third Party) New Enrollment Request Form

( )

GENERAL

Please type or print clearly. Return the New Enrollment Request form to the EDD by mail or fax.

This authorization form is for employers who are not currently enrolled in the state data collector

program - vendor (third party) website.

The employer accepts all responsibility for managing access to their profile on the state data

collector system.

Once enrolled, you will receive a confirmation letter with instructions on how to create your profile

and add a bank account to be used for debiting. You will also be able to update your bank account

information directly from the state data collector website.

SECTION I

Complete all information in this section.

Business Name - Enter the business name.

Business Mailing Address - Enter the business mailing address.

Employer Account Number - The EDD employer payroll tax account number is required.

Enter the eight-digit employer payroll tax account number assigned by the EDD, not your

Federal Employer Identification Number.

Business Phone Number - Enter the business phone number.

EFT Contact Person - Enter the name of the person who can be contacted regarding this

enrollment or tax payment inquiries.

EFT Contact Phone Number - Enter the phone number for the contact person.

SECTION II

Preparer or responsible individual, complete all information in this section.

Fax the completed form to 916-654-7441, or

Mail to:

e-Pay Unit, MIC 15A

Employment Development Department

PO Box 826880

Sacramento, CA 94280-0001

If you have questions regarding this form, please call the e-Pay Unit at 916-654-9130.

DE 26 Rev. 10 (6-16) (INTERNET)

Page 2 of 2

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1