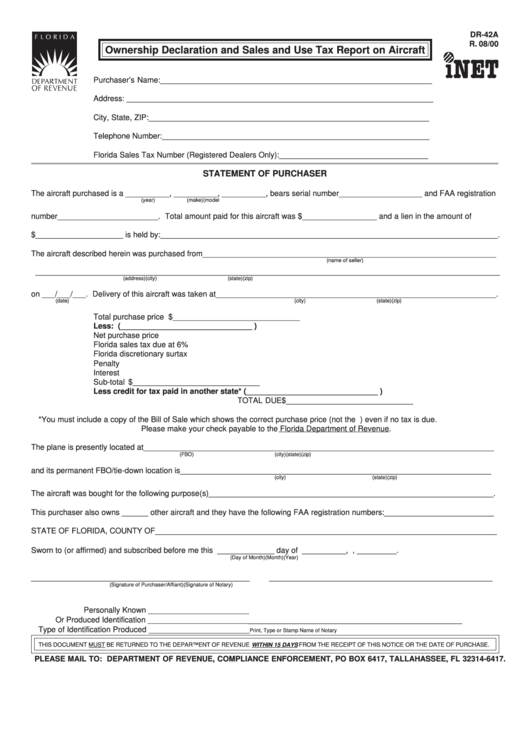

Form Dr-42a - Ownership Declaration And Sales And Use Tax Report On Aircraft

ADVERTISEMENT

DR-42A

R. 08/00

Ownership Declaration and Sales and Use Tax Report on Aircraft

Purchaser’s Name: ______________________________________________________________

Address: ______________________________________________________________________

City, State, ZIP: ________________________________________________________________

Telephone Number: _____________________________________________________________

Florida Sales Tax Number (Registered Dealers Only): __________________________________

STATEMENT OF PURCHASER

The aircraft purchased is a __________, __________, __________, bears serial number___________________ and FAA registration

(year)

(make)

(model

number_______________________. Total amount paid for this aircraft was $_________________ and a lien in the amount of

$____________________ is held by: _____________________________________________________________________________ .

The aircraft described herein was purchased from ___________________________________________________________________

(name of seller)

__________________________________________________________________________________________________________

(address)

(city)

(state)

(zip)

on ___/___/___. Delivery of this aircraft was taken at ________________________________________________________________ .

(date)

(city)

(state)

(zip)

Total purchase price ...................................................

$ _____________________________

Less: trade-in ............................................................

( ______________________________ )

Net purchase price .....................................................

______________________________

Florida sales tax due at 6% ........................................

______________________________

Florida discretionary surtax ........................................

______________________________

Penalty .......................................................................

______________________________

Interest .......................................................................

______________________________

Sub-total .....................................................................

$ _____________________________

Less credit for tax paid in another state* ...............

( ______________________________ )

TOTAL DUE

$ _____________________________

*You must include a copy of the Bill of Sale which shows the correct purchase price (not the F.A.A. Bill of Sale) even if no tax is due.

Please make your check payable to the Florida Department of Revenue.

The plane is presently located at ________________________________________________________________________________

(FBO)

(city)

(state)

(zip)

and its permanent FBO/tie-down location is _______________________________________________________________________

(city)

(state)

(zip)

The aircraft was bought for the following purpose(s) _________________________________________________________________ .

This purchaser also owns ______ other aircraft and they have the following FAA registration numbers: _________________________

STATE OF FLORIDA, COUNTY OF ______________________________________________________________________________

Sworn to (or affirmed) and subscribed before me this _____________ day of __________, A.D., _________.

(Day of Month)

(Month)

(Year)

______________________________________________

_______________________________________________

(Signature of Purchaser/Affiant)

(Signature of Notary)

Personally Known _______________________

_____________________________________________

Or Produced Identification _______________________

Type of Identification Produced _______________________

Print, Type or Stamp Name of Notary

THIS DOCUMENT MUST BE RETURNED TO THE DEPARTMENT OF REVENUE WITHIN 15 DAYS FROM THE RECEIPT OF THIS NOTICE OR THE DATE OF PURCHASE.

PLEASE MAIL TO: DEPARTMENT OF REVENUE, COMPLIANCE ENFORCEMENT, PO BOX 6417, TALLAHASSEE, FL 32314-6417.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1