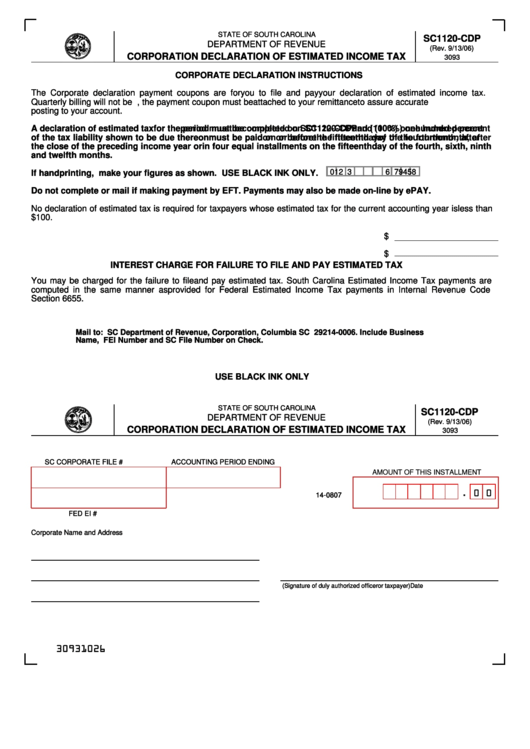

Form Sc1120-Cdp - Corporation Declaration Of Estimated Income Tax

ADVERTISEMENT

STATE OF SOUTH CAROLINA

STATE OF SOUTH CAROLINA

SC1120-CDP

SC1120-CDP

DEPARTMENT OF REVENUE

DEPARTMENT OF REVENUE

(Rev. 9/13/06)

(Rev. 9/13/06)

CORPORATION DECLARATION OF ESTIMATED INCOME TAX

CORPORATION DECLARATION OF ESTIMATED INCOME TAX

3093

3093

CORPORATE DECLARATION INSTRUCTIONS

CORPORATE DECLARATION INSTRUCTIONS

The Corporate declaration payment coupons are for you to file and pay your declaration of estimated income tax.

The Corporate declaration payment coupons are for you to file and pay your declaration of estimated income tax.

Quarterly billing will not be made. Therefore, the payment coupon must be attached to your remittance to assure accurate

Quarterly billing will not be made. Therefore, the payment coupon must be attached to your remittance to assure accurate

posting to your account.

posting to your account.

A declaration of estimated tax for the period must be completed on SC1120-CDP and (100%) one hundred percent

A declaration of estimated tax for the period must be completed on SC1120-CDP and (100%) one hundred percent

of the tax liability shown to be due thereon must be paid on or before the fifteenth day of the fourth month, after

of the tax liability shown to be due thereon must be paid on or before the fifteenth day of the fourth month, after

the close of the preceding income year or in four equal installments on the fifteenth day of the fourth, sixth, ninth

the close of the preceding income year or in four equal installments on the fifteenth day of the fourth, sixth, ninth

and twelfth months.

and twelfth months.

0 1 2 3

0 1 2 3

4 5

4 5

6 7

6 7

8

8

9

9

If handprinting, make your figures as shown. USE BLACK INK ONLY.

If handprinting, make your figures as shown. USE BLACK INK ONLY.

Do not complete or mail if making payment by EFT. Payments may also be made on-line by ePAY.

Do not complete or mail if making payment by EFT. Payments may also be made on-line by ePAY.

No declaration of estimated tax is required for taxpayers whose estimated tax for the current accounting year is less than

No declaration of estimated tax is required for taxpayers whose estimated tax for the current accounting year is less than

$100.

$100.

A. Estimated tax for the current accounting year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A. Estimated tax for the current accounting year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

B. Overpayment from last year credited to estimated tax for this year. . . . . . . . . . . . . . . . . .

B. Overpayment from last year credited to estimated tax for this year. . . . . . . . . . . . . . . . . .

$

$

INTEREST CHARGE FOR FAILURE TO FILE AND PAY ESTIMATED TAX

INTEREST CHARGE FOR FAILURE TO FILE AND PAY ESTIMATED TAX

You may be charged for the failure to file and pay estimated tax. South Carolina Estimated Income Tax payments are

You may be charged for the failure to file and pay estimated tax. South Carolina Estimated Income Tax payments are

computed in the same manner as provided for Federal Estimated Income Tax payments in Internal Revenue Code

computed in the same manner as provided for Federal Estimated Income Tax payments in Internal Revenue Code

Section 6655.

Section 6655.

Mail to: SC Department of Revenue, Corporation, Columbia SC 29214-0006. Include Business

Mail to: SC Department of Revenue, Corporation, Columbia SC 29214-0006. Include Business

Name, FEI Number and SC File Number on Check.

Name, FEI Number and SC File Number on Check.

USE BLACK INK ONLY

USE BLACK INK ONLY

STATE OF SOUTH CAROLINA

STATE OF SOUTH CAROLINA

SC1120-CDP

SC1120-CDP

DEPARTMENT OF REVENUE

DEPARTMENT OF REVENUE

(Rev. 9/13/06)

(Rev. 9/13/06)

CORPORATION DECLARATION OF ESTIMATED INCOME TAX

CORPORATION DECLARATION OF ESTIMATED INCOME TAX

3093

3093

SC CORPORATE FILE #

SC CORPORATE FILE #

ACCOUNTING PERIOD ENDING

ACCOUNTING PERIOD ENDING

AMOUNT OF THIS INSTALLMENT

.

0 0

14-0807

14-0807

14-0807

FED EI #

FED EI #

Corporate Name and Address

Corporate Name and Address

(Signature of duly authorized officer or taxpayer)

(Signature of duly authorized officer or taxpayer)

Date

Date

30931026

30931026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1