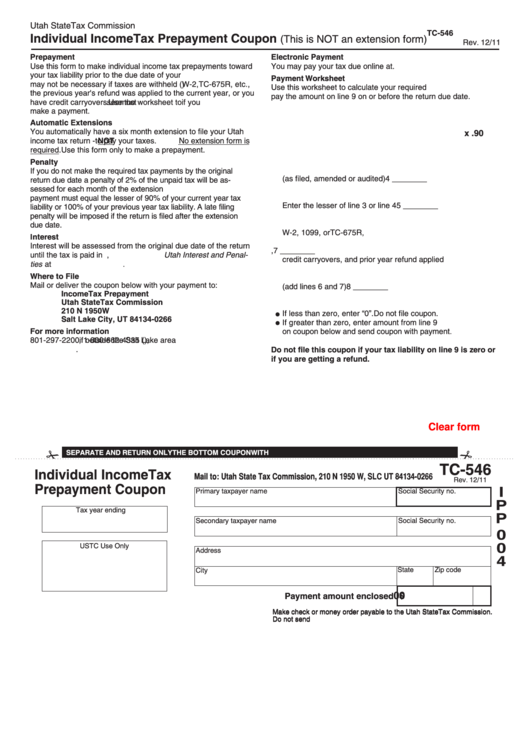

Utah State Tax Commission

TC-546

Individual Income Tax Prepayment Coupon

(This is NOT an extension form)

Rev. 12/11

Prepayment

Electronic Payment

Use this form to make individual income tax prepayments toward

You may pay your tax due online at

taxexpress.utah.gov

.

your tax liability prior to the due date of your return. Prepayments

Payment Worksheet

may not be necessary if taxes are withheld (

W-2, TC-675R, etc. ,

)

Use this worksheet to calculate your required payment. You must

the previous year's refund was applied to the current year, or you

pay the amount on line 9 on or before the return due date.

have credit carryovers

. Use the worksheet to

see

if you

must

make a

payment.

1. Tax you expect to owe this year

1 ________

Automatic Extensions

You automatically have a six month extension to file your Utah

x .90

2. Minimum payment rate

2

income tax return -

NOT

to pay your taxes.

No extension form is

required

. Use this form only to make a prepayment.

3. Multiply line 1 by the rate on line 2

3 ________

Penalty

4. Utah tax liability for the previous year

If you do not make the required tax payments by the original

(as filed, amended or audited)

4 ________

return due date a penalty of 2% of the unpaid tax will be as-

sessed for each month of the extension period. The required

5. Minimum tax due by original due date

payment must equal the lesser of 90% of your current year tax

Enter the lesser of line 3 or line 4

5 ________

liability or 100% of your previous year tax liability.

A late filing

penalty will be imposed if the return is filed after the extension

6. Utah income tax withheld from forms

due date.

W-2, 1099, or TC-675R, etc. for this year

6 ________

I

nterest

Interest will be assessed from the original due date of the return

7. Previous prepayments made for this year,

7 ________

until the tax is paid in full. See Pub 58,

Utah Interest and Penal-

credit carryovers, and prior year refund applied

ties

at

tax.utah.gov/forms

.

Where to File

8. Total prepayments for this year

Mail or deliver the coupon below with your payment to:

(add lines 6 and 7)

8 ________

Income Tax Prepayment

Utah State Tax Commission

9. Payment due - subtract line 8 from line 5

9 ________

210 N 1950 W

If less than zero, enter “0”. Do not file coupon.

Salt Lake City, UT 84134-0266

If greater than zero, enter amount from line 9

For more information

on coupon below and send coupon with payment.

801-297-2200

, 1-800-662-4335 (

if outside the Salt Lake area

),

tax.utah.gov

.

Do not file this coupon if your tax liability on line 9 is zero or

if you are getting a refund.

Clear form

SEPARATE AND RETURN ONLY THE BOTTOM COUPON WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS.

TC-546

Individual Income Tax

Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT 84134-0266

Rev. 12/11

Prepayment Coupon

I

Primary taxpayer name

Social Security no.

P

Tax year ending

P

Secondary taxpayer name

Social Security no.

0

0

USTC Use Only

Address

4

State

Zip code

City

00

$

Payment amount enclosed

Make check or money order payable to the Utah State Tax Commission.

Make check or money order payable to the Utah State Tax Commission.

Do not send cash. Do not staple check to coupon. Detach check stub.

Do not send cash. Do not staple check to coupon. Detach check stub.

1

1