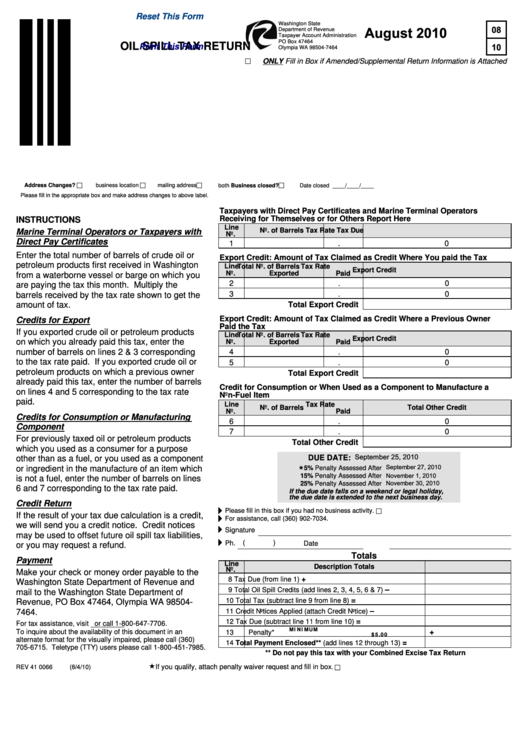

Reset This Form

Washington State

August 2010

08

Department of Revenue

Taxpayer Account Administration

PO Box 47464

10

Print This Form

Olympia WA 98504-7464

OIL SPILL TAX RETURN

ONLY Fill in Box if Amended/Supplemental Return Information is Attached

Address Changes?

business location

mailing address

both

Business closed?

Date closed ____/____/____

Please fill in the appropriate box and make address changes to above label.

Taxpayers with Direct Pay Certificates and Marine Terminal Operators

Receiving for Themselves or for Others Report Here

INSTRUCTIONS

Line

No. of Barrels

Tax Rate

Tax Due

Marine Terminal Operators or Taxpayers with

No.

Direct Pay Certificates

1

.04

Enter the total number of barrels of crude oil or

Export Credit: Amount of Tax Claimed as Credit Where You paid the Tax

petroleum products first received in Washington

Line

Total No. of Barrels

Tax Rate

Export Credit

No.

Exported

Paid

from a waterborne vessel or barge on which you

2

.04

are paying the tax this month. Multiply the

3

.05

barrels received by the tax rate shown to get the

amount of tax.

Total Export Credit

Export Credit: Amount of Tax Claimed as Credit Where a Previous Owner

Credits for Export

Paid the Tax

If you exported crude oil or petroleum products

Line

Total No. of Barrels

Tax Rate

Export Credit

on which you already paid this tax, enter the

No.

Exported

Paid

number of barrels on lines 2 & 3 corresponding

4

.04

to the tax rate paid. If you exported crude oil or

5

.05

petroleum products on which a previous owner

Total Export Credit

already paid this tax, enter the number of barrels

Credit for Consumption or When Used as a Component to Manufacture a

on lines 4 and 5 corresponding to the tax rate

Non-Fuel Item

paid.

Line

Tax Rate

No. of Barrels

Total Other Credit

No.

Paid

Credits for Consumption or Manufacturing

6

.04

Component

7

.05

For previously taxed oil or petroleum products

Total Other Credit

which you used as a consumer for a purpose

September 25, 2010

DUE DATE:

other than as a fuel, or you used as a component

September 27, 2010

or ingredient in the manufacture of an item which

5% Penalty Assessed After

November 1, 2010

15% Penalty Assessed After

is not a fuel, enter the number of barrels on lines

November 30, 2010

25% Penalty Assessed After

6 and 7 corresponding to the tax rate paid.

If the due date falls on a weekend or legal holiday,

the due date is extended to the next business day.

Credit Return

4

Please fill in this box if you had no business activity.

If the result of your tax due calculation is a credit,

4

For assistance, call (360) 902-7034.

we will send you a credit notice. Credit notices

4

Signature

may be used to offset future oil spill tax liabilities,

4

Ph. (

)

Date

or you may request a refund.

Totals

Payment

Line

Description

Totals

No.

Make your check or money order payable to the

+

8

Tax Due (from line 1)

Washington State Department of Revenue and

–

9

Total Oil Spill Credits (add lines 2, 3, 4, 5, 6 & 7)

mail to the Washington State Department of

=

10

Total Tax (subtract line 9 from line 8)

Revenue, PO Box 47464, Olympia WA 98504-

–

7464.

11

Credit Notices Applied (attach Credit Notice)

=

12

Tax Due (subtract line 11 from line 10)

For tax assistance, visit dor.wa.gov or call 1-800-647-7706.

MINIMUM

To inquire about the availability of this document in an

+

13

Penalty*

$5.00

alternate format for the visually impaired, please call (360)

=

14

Total Payment Enclosed** (add lines 12 through 13)

705-6715. Teletype (TTY) users please call 1-800-451-7985.

** Do not pay this tax with your Combined Excise Tax Return

If you qualify, attach penalty waiver request and fill in box

REV 41 0066

(8/4/10)

.

1

1