Tab to navigate within form. Use mouse to check

Clear

Print

applicable boxes, press spacebar or press Enter.

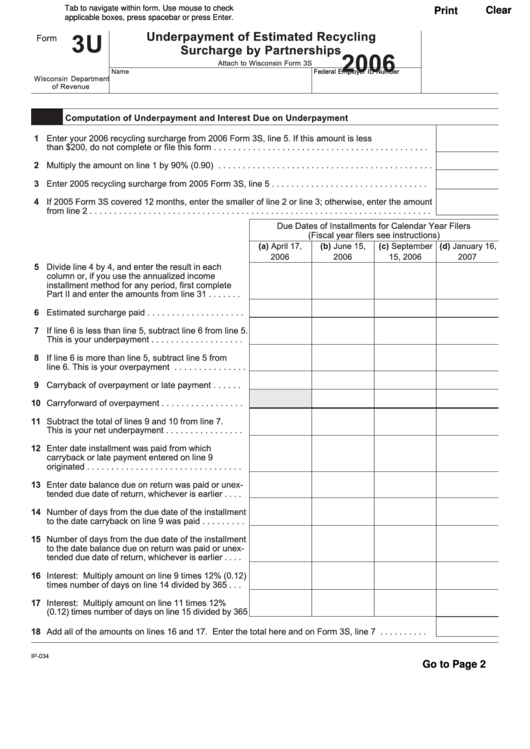

Underpayment of Estimated Recycling

3U

Form

Surcharge by Partnerships

2006

Attach to Wisconsin Form 3S

Name

Federal Employer ID Number

Wisconsin Department

of Revenue

Part I

Computation of Underpayment and Interest Due on Underpayment

1 Enter your 2006 recycling surcharge from 2006 Form 3S, line 5. If this amount is less

than $200, do not complete or file this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Multiply the amount on line 1 by 90% (0.90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Enter 2005 recycling surcharge from 2005 Form 3S, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 If 2005 Form 3S covered 12 months, enter the smaller of line 2 or line 3; otherwise, enter the amount

from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Due Dates of Installments for Calendar Year Filers

(Fiscal year filers see instructions)

(a) April 17,

(b) June 15,

(c) September

(d) January 16,

2006

2006

15, 2006

2007

5 Divide line 4 by 4, and enter the result in each

column or, if you use the annualized income

installment method for any period, first complete

Part II and enter the amounts from line 31 . . . . . . .

6 Estimated surcharge paid . . . . . . . . . . . . . . . . . . . .

7 If line 6 is less than line 5, subtract line 6 from line 5.

This is your underpayment . . . . . . . . . . . . . . . . . . .

8 If line 6 is more than line 5, subtract line 5 from

line 6. This is your overpayment . . . . . . . . . . . . . . .

9 Carryback of overpayment or late payment . . . . . .

10 Carryforward of overpayment . . . . . . . . . . . . . . . . .

11 Subtract the total of lines 9 and 10 from line 7.

This is your net underpayment . . . . . . . . . . . . . . . .

12 Enter date installment was paid from which

carryback or late payment entered on line 9

originated . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Enter date balance due on return was paid or unex-

tended due date of return, whichever is earlier . . . .

14 Number of days from the due date of the installment

to the date carryback on line 9 was paid . . . . . . . . .

15 Number of days from the due date of the installment

to the date balance due on return was paid or unex-

tended due date of return, whichever is earlier . . . .

16 Interest: Multiply amount on line 9 times 12% (0.12)

times number of days on line 14 divided by 365 . . .

17 Interest: Multiply amount on line 11 times 12%

(0.12) times number of days on line 15 divided by 365

18 Add all of the amounts on lines 16 and 17. Enter the total here and on Form 3S, line 7 . . . . . . . . . .

IP-034

Go to Page 2

1

1 2

2