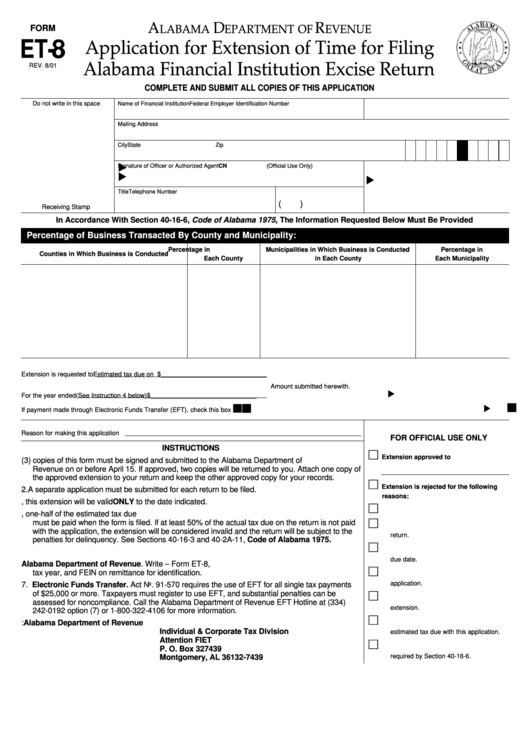

Form Et-8 - Application For Extension Of Time For Filing Alabama Financial Institution Excise Return - 2001

ADVERTISEMENT

A

D

R

LABAMA

EPARTMENT OF

EVENUE

FORM

ET-8

Application for Extension of Time for Filing

Alabama Financial Institution Excise Return

REV. 8/01

COMPLETE AND SUBMIT ALL COPIES OF THIS APPLICATION

Name of Financial Institution

Federal Employer Identification Number

Do not write in this space

Mailing Address

City

State

Zip

Signature of Officer or Authorized Agent

CN

(Official Use Only)

Title

Telephone Number

(

)

Receiving Stamp

In Accordance With Section 40-16-6, Code of Alabama 1975, The Information Requested Below Must Be Provided

Percentage of Business Transacted By County and Municipality:

Percentage in

Municipalities in Which Business is Conducted

Percentage in

Counties in Which Business is Conducted

Each County

in Each County

Each Municipality

Extension is requested to

Estimated tax due on return . . . . . . . . . . . . . . . . $______________________________

Amount submitted herewith.

For the year ended

(See Instruction 4 below) . . . . . . . . . . . . . . .

$______________________________

If payment made through Electronic Funds Transfer (EFT), check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Reason for making this application

FOR OFFICIAL USE ONLY

INSTRUCTIONS

Extension approved to

1. Three (3) copies of this form must be signed and submitted to the Alabama Department of

Revenue on or before April 15. If approved, two copies will be returned to you. Attach one copy of

the approved extension to your return and keep the other approved copy for your records.

Extension is rejected for the following

2. A separate application must be submitted for each return to be filed.

reasons:

3. If approved, this extension will be valid ONLY to the date indicated.

1. This form was not properly signed.

4. In order for this application to be approved and remain valid, one-half of the estimated tax due

must be paid when the form is filed. If at least 50% of the actual tax due on the return is not paid

2. This form was made for more than one

with the application, the extension will be considered invalid and the return will be subject to the

return.

penalties for delinquency. See Sections 40-16-3 and 40-2A-11, Code of Alabama 1975.

3. This application was not received by the

5. This application will not be approved unless all information requested above is provided.

due date.

6. Remittance should be made payable to Alabama Department of Revenue. Write – Form ET-8,

tax year, and FEIN on remittance for identification.

4. No reason was given for making the

application.

7. Electronic Funds Transfer. Act No. 91-570 requires the use of EFT for all single tax payments

of $25,000 or more. Taxpayers must register to use EFT, and substantial penalties can be

5. Reason given not grounds justifying

assessed for noncompliance. Call the Alabama Department of Revenue EFT Hotline at (334)

extension.

242-0192 option (7) or 1-800-322-4106 for more information.

6. Taxpayer failed to submit one-half of the

8. Mail all copies of this application to:

Alabama Department of Revenue

Individual & Corporate Tax Division

estimated tax due with this application.

Attention FIET

7. Taxpayer failed to provide information

P. O. Box 327439

required by Section 40-16-6.

Montgomery, AL 36132-7439

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1