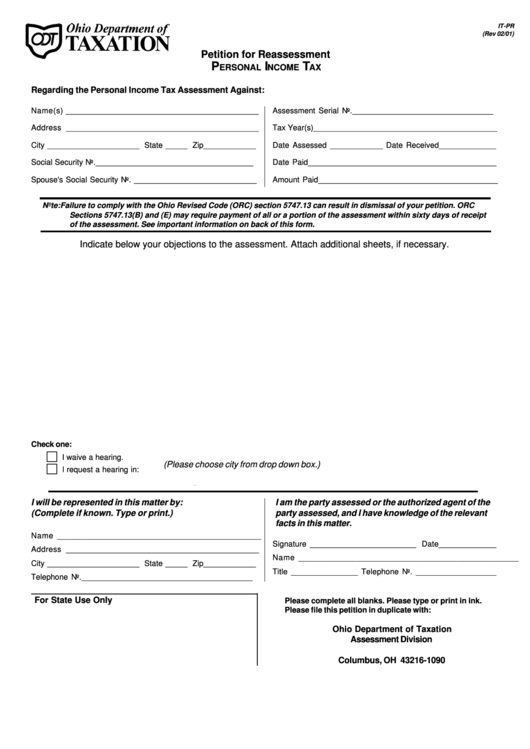

IT-PR

(Rev 02/01)

Petition for Reassessment

P

I

T

ERSONAL

NCOME

AX

Regarding the Personal Income Tax Assessment Against:

Name(s) ____________________________________________

Assessment Serial No. ________________________________

Address ____________________________________________

Tax Year(s) __________________________________________

City _____________________ State _____ Zip ____________

Date Assessed ____________ Date Received _____________

Social Security No. ____________________________________

Date Paid ___________________________________________

Spouse's Social Security No. ____________________________

Amount Paid _________________________________________

Note: Failure to comply with the Ohio Revised Code (ORC) section 5747.13 can result in dismissal of your petition. ORC

Sections 5747.13(B) and (E) may require payment of all or a portion of the assessment within sixty days of receipt

of the assessment. See important information on back of this form.

Indicate below your objections to the assessment. Attach additional sheets, if necessary.

Check one:

c

I waive a hearing.

(Please choose city from drop down box.)

c

I request a hearing in:

Columbus

Dayton

I will be represented in this matter by:

I am the party assessed or the authorized agent of the

(Complete if known. Type or print.)

party assessed, and I have knowledge of the relevant

facts in this matter.

Name ______________________________________________

Signature ________________________ Date _____________

Address ____________________________________________

Name ______________________________________________

City _____________________ State _____ Zip ____________

Title _______________ Telephone No. __________________

Telephone No. _______________________________________

For State Use Only

Please complete all blanks. Please type or print in ink.

Please file this petition in duplicate with:

Ohio Department of Taxation

Assessment Division

P.O. Box 1090

Columbus, OH 43216-1090

1

1