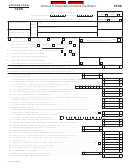

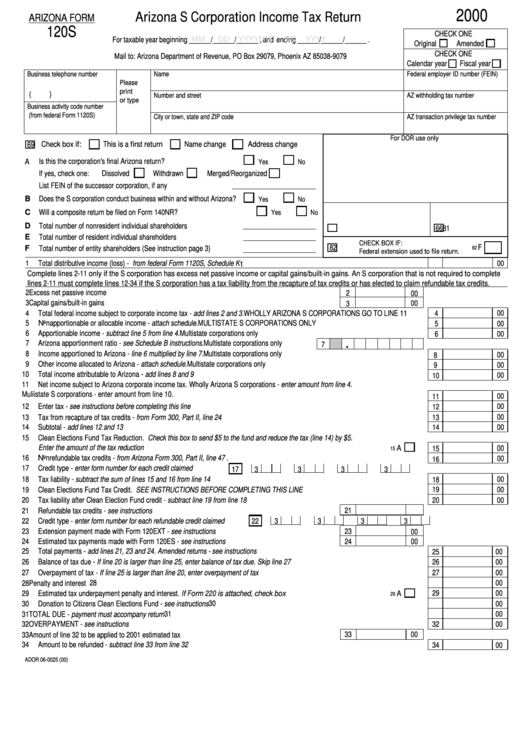

Arizona Form 120s - Arizona S Corporation Income Tax Return - 2000

ADVERTISEMENT

2000

Arizona S Corporation Income Tax Return

ARIZONA FORM

120S

CHECK ONE

For taxable year beginning ______/______/______ , and ending ______/______/______ .

MM

DD

YYYY

MM

DD

YYYY

Original

Amended

CHECK ONE

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Calendar year

Fiscal year

Name

Federal employer ID number (FEIN)

Business telephone number

Please

print

(

)

Number and street

AZ withholding tax number

or type

Business activity code number

(from federal Form 1120S)

City or town, state and ZIP code

AZ transaction privilege tax number

For DOR use only

69

Check box if:

This is a first return

Name change

Address change

A

Is this the corporation's final Arizona return?

Yes

No

If yes, check one:

Dissolved

Withdrawn

Merged/Reorganized

List FEIN of the successor corporation, if any

Does the S corporation conduct business within and without Arizona?

Yes

No

B

Will a composite return be filed on Form 140NR?

Yes

No

C

Total number of nonresident individual shareholders

D

81

66

Total number of resident individual shareholders

E

CHECK BOX IF:

F

82

Total number of entity shareholders (See instruction page 3)

82

F

Federal extension used to file return.

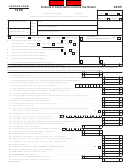

1

Total distributive income (loss) - from federal Form 1120S, Schedule K .......................................................................................................

00

1

Complete lines 2-11 only if the S corporation has excess net passive income or capital gains/built-in gains. An S corporation that is not required to complete

lines 2-11 must complete lines 12-34 if the S corporation has a tax liability from the recapture of tax credits or has elected to claim refundable tax credits.

2

Excess net passive income ..........................................................................................................................

2

00

3

Capital gains/built-in gains .............................................................................................................................

00

3

4

Total federal income subject to corporate income tax - add lines 2 and 3. WHOLLY ARIZONA S CORPORATIONS GO TO LINE 11 .......

4

00

5

Nonapportionable or allocable income - attach schedule. MULTISTATE S CORPORATIONS ONLY ..........................................................

5

00

6

Apportionable income - subtract line 5 from line 4. Multistate corporations only ............................................................................................

6

00

7

Arizona apportionment ratio - see Schedule B instructions. Multistate corporations only ................

7

8

Income apportioned to Arizona - line 6 multiplied by line 7. Multistate corporations only ...............................................................................

00

8

9

Other income allocated to Arizona - attach schedule. Multistate corporations only ........................................................................................

9

00

10

Total income attributable to Arizona - add lines 8 and 9 .................................................................................................................................

10

00

11

Net income subject to Arizona corporate income tax. Wholly Arizona S corporations - enter amount from line 4.

Muliistate S corporations - enter amount from line 10. ....................................................................................................................................

00

11

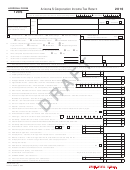

12

Enter tax - see instructions before completing this line ...................................................................................................................................

12

00

00

13

Tax from recapture of tax credits - from Form 300, Part II, line 24 .................................................................................................................

13

14

Subtotal - add lines 12 and 13 ..................................................................................................................................... . ...................................

14

00

15

Clean Elections Fund Tax Reduction. Check this box to send $5 to the fund and reduce the tax (line 14) by $5.

Enter the amount of the tax reduction .........................................................................................................................................

A

00

15

15

16

Nonrefundable tax credits - from Arizona Form 300, Part II, line 47 ...............................................................................................................

00

16

17

Credit type - enter form number for each credit claimed .................

17

3

3

3

3

18

Tax liability - subtract the sum of lines 15 and 16 from line 14 .......................................................................................................................

00

18

19

Clean Elections Fund Tax Credit. SEE INSTRUCTIONS BEFORE COMPLETING THIS LINE ...................................................................

19

00

20

Tax liability after Clean Election Fund credit - subtract line 19 from line 18 ...................................................................................................

20

00

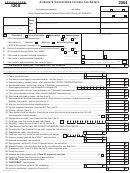

21

21

Refundable tax credits - see instructions .......................................................................................................

22

Credit type - enter form number for each refundable credit claimed ..........

22

3

3

3

3

23

23

Extension payment made with Form 120EXT - see instructions ...................................................................

00

24

Estimated tax payments made with Form 120ES - see instructions ..............................................................

24

00

25

Total payments - add lines 21, 23 and 24. Amended returns - see instructions .............................................................................................

25

00

26

Balance of tax due - If line 20 is larger than line 25, enter balance of tax due. Skip line 27 ...........................................................................

26

00

27

00

27

Overpayment of tax - If line 25 is larger than line 20, enter overpayment of tax .............................................................................................

28

00

28

Penalty and interest ........................................................................................................................................................................................

A

29

00

29

Estimated tax underpayment penalty and interest. If Form 220 is attached, check box .............................................................

29

30

00

30

Donation to Citizens Clean Elections Fund - see instructions ........................................................................................................................

31

00

31

TOTAL DUE - payment must accompany return ............................................................................................................................................

32

OVERPAYMENT - see instructions ................................................................................................................................................................

32

00

33

00

33

Amount of line 32 to be applied to 2001 estimated tax ..................................................................................

34

Amount to be refunded - subtract line 33 from line 32 ....................................................................................................................................

34

00

ADOR 06-0025 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2