PRINT

CLEAR

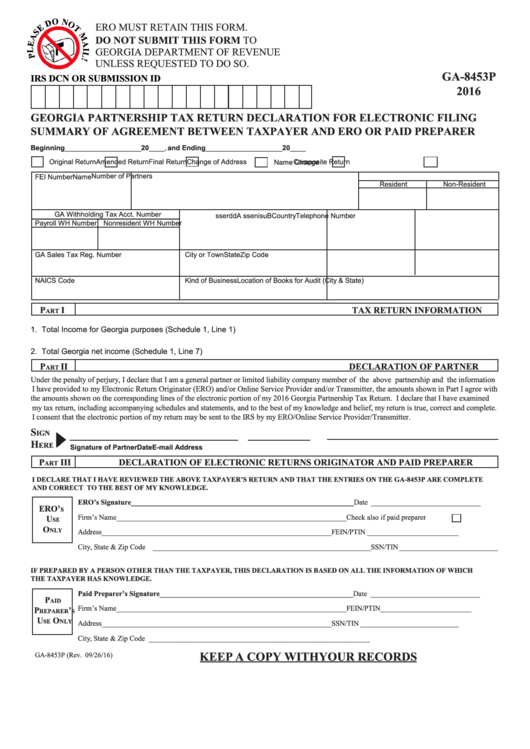

ERO MUST RETAIN THIS FORM.

DO NOT SUBMIT THIS FORM TO

GEORGIA DEPARTMENT OF REVENUE

UNLESS REQUESTED TO DO SO.

GA-8453P

IRS DCN OR SUBMISSION ID

2016

GEORGIA PARTNERSHIP TAX RETURN DECLARATION FOR ELECTRONIC FILING

SUMMARY OF AGREEMENT BETWEEN TAXPAYER AND ERO OR PAID PREPARER

Beginning____________________20____, and Ending____________________20____

Original Return

Amended Return

Final Return

Change of Address

Composite Return

Name Change

Number of Partners

FEI Number

Name

Resident

Non-Resident

GA Withholding Tax Acct. Number

B

s u

n i

e

s s

A

d

d

e r

s s

Country

Telephone Number

Payroll WH Number Nonresident WH Number

GA Sales Tax Reg. Number

City or Town

State

Zip Code

NAICS Code

Kind of Business

Location of Books for Audit (City & State)

P

I

TAX RETURN INFORMATION

ART

1. Total Income for Georgia purposes (Schedule 1, Line 1) ...................................................

1. _____________________________

2. Total Georgia net income (Schedule 1, Line 7) ...................................................................

2. _____________________________

P

II

DECLARATION OF PARTNER

ART

Under the penalty of perjury, I declare that I am a general partner or limited liability company member of the above partnership and the information

I have provided to my Electronic Return Originator (ERO) and/or Online Service Provider and/or Transmitter, the amounts shown in Part I agree with

the amounts shown on the corresponding lines of the electronic portion of my 2016 Georgia Partnership Tax Return. I declare that I have examined

my tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, my return is true, correct and complete.

I consent that the electronic portion of my return may be sent to the IRS by my ERO/Online Service Provider/Transmitter.

S

IGN

H

ERE

Signature of Partner

Date

E-mail Address

P

III

DECLARATION OF ELECTRONIC RETURNS ORIGINATOR AND PAID PREPARER

ART

I DECLARE THAT I HAVE REVIEWED THE ABOVE TAXPAYER’S RETURN AND THAT THE ENTRIES ON THE GA-8453P ARE COMPLETE

AND CORRECT TO THE BEST OF MY KNOWLEDGE.

ERO’s Signature _____________________________________________________________

Date ______________________________

ERO’

S

Firm’s Name

_______________________________________________________________

Check also if paid preparer

U

SE

O

NLY

Address

_______________________________________________________________

FEIN/PTIN _________________________

City, State & Zip Code ____________________________________________________________ SSN/TIN ___________________________

IF PREPARED BY A PERSON OTHER THAN THE TAXPAYER, THIS DECLARATION IS BASED ON ALL THE INFORMATION OF WHICH

THE TAXPAYER HAS KNOWLEDGE.

Paid Preparer’s Signature _____________________________________________________

Date ______________________________

P

AID

Firm’s Name

_______________________________________________________________

FEIN/PTIN _________________________

P

’

REPARER

S

U

O

SE

NLY

Address

_______________________________________________________________

SSN/TIN ___________________________

City, State & Zip Code _____________________________________________________________

KEEP A COPY WITH YOUR RECORDS

GA-8453P (Rev. 09/26/16)

1

1