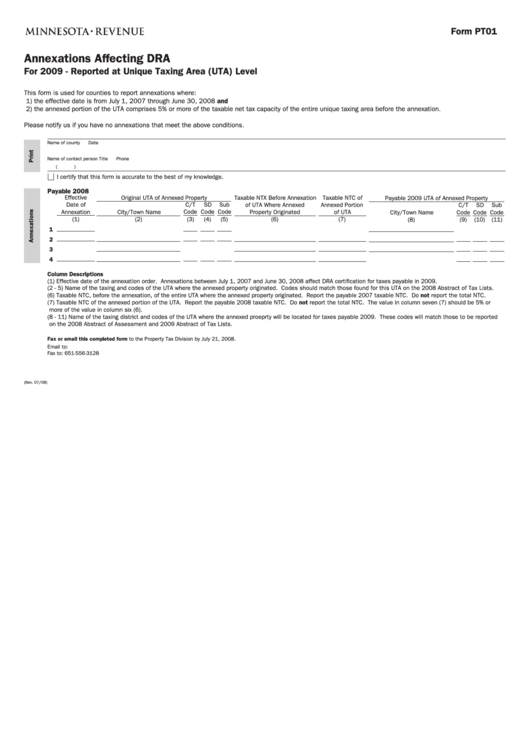

Form PT01

Annexations Affecting DRA

For 2009 - Reported at Unique Taxing Area (UTA) Level

This form is used for counties to report annexations where:

1) the effective date is from July 1, 2007 through June 30, 2008 and

2) the annexed portion of the UTA comprises 5% or more of the taxable net tax capacity of the entire unique taxing area before the annexation.

Please notify us if you have no annexations that meet the above conditions.

Name of county

Date

Name of contact person

Title

Phone

(

)

I certify that this form is accurate to the best of my knowledge.

Payable 2008

Effective

Original UTA of Annexed Property

Taxable NTX Before Annexation

Taxable NTC of

Payable 2009 UTA of Annexed Property

Date of

C/T

SD

Sub

of UTA Where Annexed

Annexed Portion

C/T

SD

Sub

Annexation

Code

Code

Code

City/Town Name

Property Originated

of UTA

Code

Code

Code

City/Town Name

(3)

(4)

(5)

(1)

(2)

(6)

(7)

(9)

(10)

(11)

(8)

1

2

3

4

Column Descriptions

(1)

Effective date of the annexation order. Annexations between July 1, 2007 and June 30, 2008 affect DRA certification for taxes payable in 2009.

(2 - 5)

Name of the taxing and codes of the UTA where the annexed property originated. Codes should match those found for this UTA on the 2008 Abstract of Tax Lists.

(6)

Taxable NTC, before the annexation, of the entire UTA where the annexed property originated. Report the payable 2007 taxable NTC. Do not report the total NTC.

(7)

Taxable NTC of the annexed portion of the UTA. Report the payable 2008 taxable NTC. Do not report the total NTC. The value in column seven (7) should be 5% or

more of the value in column six (6).

(8 - 11) Name of the taxing district and codes of the UTA where the annexed proeprty will be located for taxes payable 2009. These codes will match those to be reported

on the 2008 Abstract of Assessment and 2009 Abstract of Tax Lists.

Fax or email this completed form to the Property Tax Division by July 21, 2008.

Email to: jodi.rubbelke@state.mn.us

Fax to: 651-556-3128

(Rev. 07/08)

1

1