1099/1098 Preparation Form

Download a blank fillable 1099/1098 Preparation Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete 1099/1098 Preparation Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

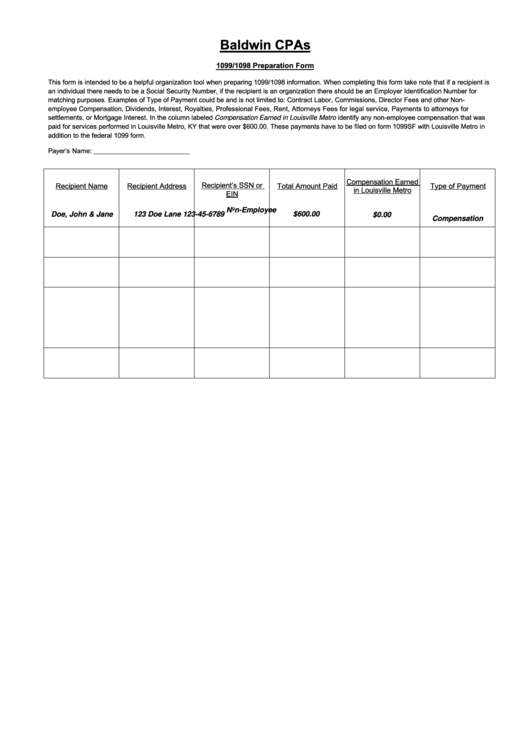

Baldwin CPAs

1099/1098 Preparation Form

This form is intended to be a helpful organization tool when preparing 1099/1098 information. When completing this form take note that if a recipient is

an individual there needs to be a Social Security Number, if the recipient is an organization there should be an Employer Identification Number for

matching purposes. Examples of Type of Payment could be and is not limited to: Contract Labor, Commissions, Director Fees and other Non-

employee Compensation, Dividends, Interest, Royalties, Professional Fees, Rent, Attorneys Fees for legal service, Payments to attorneys for

settlements, or Mortgage Interest. In the column labeled Compensation Earned in Louisville Metro identify any non-employee compensation that was

paid for services performed in Louisville Metro, KY that were over $600.00. These payments have to be filed on form 1099SF with Louisville Metro in

addition to the federal 1099 form.

Payer’s Name:

Compensation Earned

Recipient’s SSN or

Recipient Name

Recipient Address

Total Amount Paid

Type of Payment

in Louisville Metro

EIN

Non-Employee

Doe, John & Jane

123 Doe Lane

123-45-6789

$600.00

$0.00

Compensation

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2