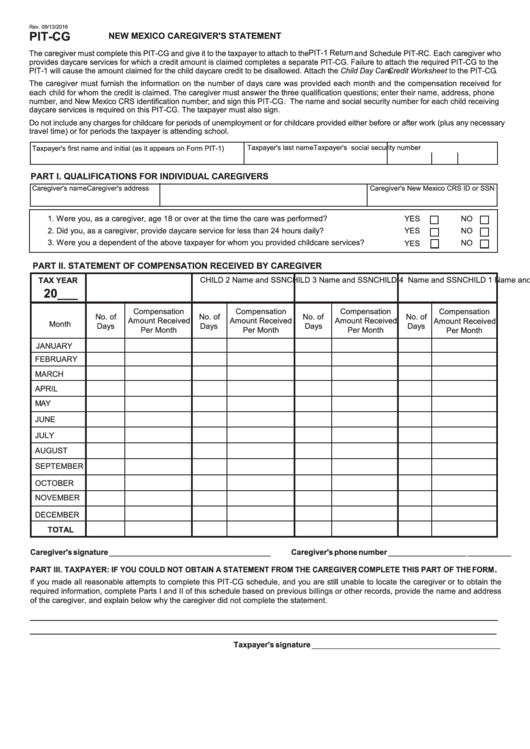

Rev. 09/13/2016

PIT-CG

NEW MEXICO CAREGIVER'S STATEMENT

The caregiver must complete this PIT-CG and give it to the taxpayer to attach to the PIT-1 Return and Schedule PIT-RC. Each caregiver who

provides daycare services for which a credit amount is claimed completes a separate PIT-CG. Failure to attach the required PIT-CG to the

PIT-1 will cause the amount claimed for the child daycare credit to be disallowed. Attach the Child Day Care Credit Worksheet to the PIT-CG.

The caregiver must furnish the information on the number of days care was provided each month and the compensation received for

each child for whom the credit is claimed. The caregiver must answer the three qualification questions; enter their name, address, phone

number, and New Mexico CRS identification number; and sign this PIT-CG. The name and social security number for each child receiving

daycare services is required on this PIT-CG. The taxpayer must also sign.

Do not include any charges for childcare for periods of unemployment or for childcare provided either before or after work (plus any necessary

travel time) or for periods the taxpayer is attending school.

Taxpayer's last name

Taxpayer's social security number

Taxpayer's first name and initial (as it appears on Form PIT-1)

PART I. QUALIFICATIONS FOR INDIVIDUAL CAREGIVERS

Caregiver's name

Caregiver's address

Caregiver's New Mexico CRS ID or SSN

1. Were you, as a caregiver, age 18 or over at the time the care was performed?

YES

NO

2. Did you, as a caregiver, provide daycare service for less than 24 hours daily?

YES

NO

3. Were you a dependent of the above taxpayer for whom you provided childcare services?

NO

YES

PART II. STATEMENT OF COMPENSATION RECEIVED BY CAREGIVER

CHILD 1 Name and SSN

CHILD 2 Name and SSN

CHILD 3 Name and SSN

CHILD 4 Name and SSN

TAX YEAR

20___

Compensation

Compensation

Compensation

Compensation

No. of

No. of

No. of

No. of

Amount Received

Amount Received

Amount Received

Amount Received

Month

Days

Days

Days

Days

Per Month

Per Month

Per Month

Per Month

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

TOTAL

Caregiver's signature _____________________________________

Caregiver's phone number __________________ __________

PART III. TAXPAYER: IF YOU COULD NOT OBTAIN A STATEMENT FROM THE CAREGIVER, COMPLETE THIS PART OF THE FORM.

f you made all reasonable attempts to complete this PIT-CG schedule, and you are still unable to locate the caregiver or to obtain the

I

required information, complete Parts I and II of this schedule based on previous billings or other records, provide the name and address

of the caregiver, and explain below why the caregiver did not complete the statement.

Taxpayer's signature ___________________________________________

1

1