Instructions For Completing The Employer'S Contribution & Payroll Report - Iowa Workforce Development (Sample Form Included) Page 3

ADVERTISEMENT

D

EFINITIONS

"EXTRAORDINARY PAY" means remuneration which is not paid on a regularly

"EMPLOYEE" is an individual who performs service for an employing unit which

is considered liable for state unemployment taxes.

recurring basis to the employee such as a bonus, executive pay, profit sharing,

severance pay, etc.

A worker is classified as an employee and not an independent contractor when

"TAXABLE WAGES" means exactly the same as total wages until the "taxable

the entity for which services are being performed has the right to direct and

wage base" in effect for the particular calendar year is reached on each

control the worker, not only as to the result to be accomplished, but also by the

employee. The taxable wage base changes each year and is printed on all Iowa

details and means by which the result is accomplished. Decisions on disputed

Workforce Development computer generated tax forms.

employee versus independent contractor issues will be rendered by the Tax

Bureau.

Year and Taxable Wage Base

2000

$17,300

Length of service has no bearing on whether or not a worker is an employee.

1999

$16,500

Employees may be full-time, part-time, casual, temporary, intermittent, probation-

1998

$15,700

ary or on-call.

1997

$15,200

1996

$14,700

Certain workers are not considered "employees" for unemployment purposes.

1995

$14,200

The following is a listing of the more commonly exempt workers.

A. Individual owner of a business (sole proprietor).

B. Partners of a partnership.

EXAMPLE: For 2000, report all gross wages paid, but pay tax only up to the

C. Father or mother working for a son or daughter or a child under 18

taxable base of $17,300.00 for each employee. Example applies to a worker with

years of age in the employ of their father or mother (sole proprietor-

$5,000.00 wages a quarter.

ship). Children under 18 years of age in the employ of a partnership

consisting of father and mother. Family exemptions do not apply when

business ownership is incorporated.

Qtr

Total Wages

Taxable Wages

D. Husband or wife working for his or her spouse (sole proprietorship).

1

$5,000.00

$5,000.00

E. Service performed by a student for an employer as a formal and

2

$5,000.00

$5,000.00

accredited part of the school curriculum.

3

$5,000.00

$5,000.00

F. Independent Contractor as defined by Administrative Rule 23.19(1)-(7).

4

$5,000.00

$2,300.00

Other services or workers may be exempt. If any doubt exists, contact the field

EXPLANATION FOR #13 ON EMPLOYER'S CONTRIBUTION AND PAYROLL

auditor at the Workforce Center nearest you. Field office locations and telephone

numbers are listed in this tax booklet.

REPORT:

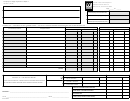

13.

Iowa Account Number

For Months Of

Qtr Yr

NOTE: OMIT EXEMPT WORKERS ENTIRELY FROM THE CONTRIBUTION

B B B B B

A A A A A

C C C C C

AND PAYROLL REPORT.

Year

Taxable Wage Base

Contribution Rate

Surcharge Rate

D D D D D

E E E E E

F F F F F

G G G G G

"TOTAL WAGES" for state unemployment insurance (SUTA) purposes means

all remuneration paid during the calendar quarter to an employee for services

Federal ID Number

Delinquent After Date

H H H H H

performed for the employer. Wages include commissions, bonuses, tips and the

I I I I I

cash value of some fringe benefits, including some employer portions of cafeteria

plans.

Employer Name & Address

J J J J J

Deductions from an employee's wages (employee's contribution) such as

deferred compensation, pre-tax insurance plans, retirement plans and many

cafeteria plan benefits are considered wages for state unemployment insurance

purposes. Generally, if the employee can choose cash instead of a benefit, the

cost of the benefit is considered wages for state unemployment insurance

(SUTA) purposes.

Benefits specifically exempted from the definition of "Wages" include:

A. Seven-digit number assigned by Iowa Workforce Development.

B. Calendar quarters are used when filing Employer's Contribution and

A. Payments made by the employer under a specific plan (each

Payroll Reports. This area shows the three months covered on each

employer's established procedures):

report.

• sick pay

• medical and hospital expense

C. Calendar quarter and year for which this report is being filed.

• accident disability

• death benefits

D. Calendar year for which the taxable wage base applies.

E. Maximum wages subject to tax for each employee for the calendar

B. Retirement benefit payments made by an employer with or without a

year.

specific plan.

F. Tax rate assigned to your account by Iowa Workforce Development for year

indicated (expressed as a percentage).

C. Payments made by an employer without a specific plan:

G. Legislated surcharge rate (expressed as a percentage), if it applies.

• sick pay after six months

H. Number assigned to your business by the Internal Revenue Service

• accident disability after six months

(not your personal Social Security Number).

• medical and hospitalization expense after six months

I. Your report is delinquent after this date. See Item 6 in instructions.

NOTE: Total wages are the basis for payment of unemployment benefit claims. It

J. Name and address-of-record for mailing of all Iowa unemployment tax

is important that these are correctly reported for each quarter.

documents.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5