Reset Form

WT AR

Rev. 3/16

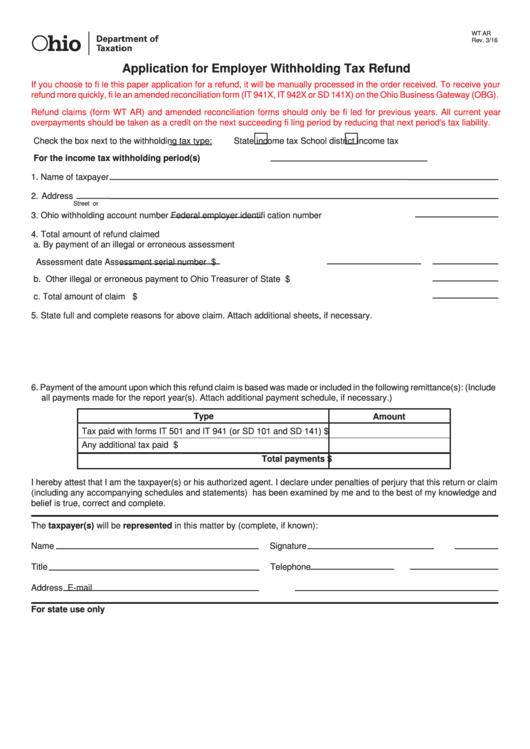

Application for Employer Withholding Tax Refund

If you choose to fi le this paper application for a refund, it will be manually processed in the order received. To receive your

refund more quickly, fi le an amended reconciliation form (IT 941X, IT 942X or SD 141X) on the Ohio Business Gateway (OBG).

Refund claims (form WT AR) and amended reconciliation forms should only be fi led for previous years. All current year

overpayments should be taken as a credit on the next succeeding fi ling period by reducing that next period's tax liability.

Check the box next to the withholding tax type:

State income tax

School district income tax

For the income tax withholding period(s)

1. Name of taxpayer

2. Address

Street or P.O. box

City

State

ZIP code

County

3. Ohio withholding account number

Federal employer identifi cation number

4. Total amount of refund claimed

a. By payment of an illegal or erroneous assessment

Assessment date

Assessment serial number

$

b. Other illegal or erroneous payment to Ohio Treasurer of State

$

c. Total amount of claim

$

5. State full and complete reasons for above claim. Attach additional sheets, if necessary.

6. Payment of the amount upon which this refund claim is based was made or included in the following remittance(s): (Include

all payments made for the report year(s). Attach additional payment schedule, if necessary.)

Type

Amount

Tax paid with forms IT 501 and IT 941 (or SD 101 and SD 141)

$

Any additional tax paid

$

Total payments

$

I hereby attest that I am the taxpayer(s) or his authorized agent. I declare under penalties of perjury that this return or claim

(including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and

belief is true, correct and complete.

The taxpayer(s) will be represented in this matter by (complete, if known):

Name

Signature

Date

Title

Telephone

Fax

Address

E-mail

For state use only

1

1