Instructions On How To Apply For A Certificate Of Discharge Of Property From Federal Tax Lien

ADVERTISEMENT

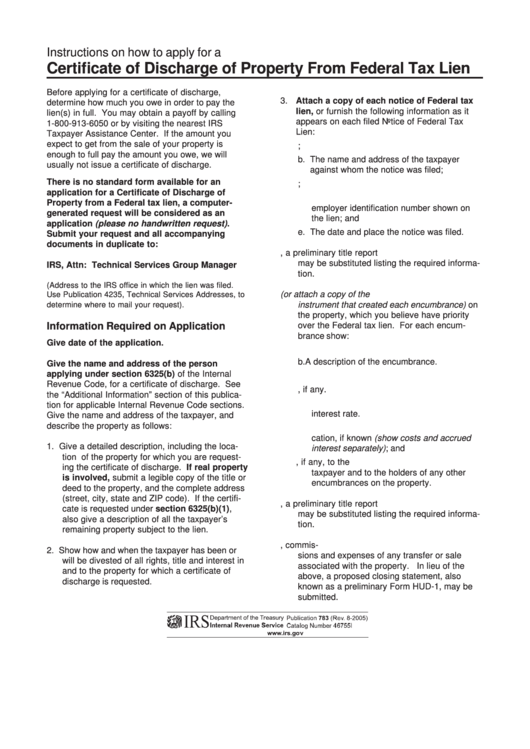

Instructions on how to apply for a

Certificate of Discharge of Property From Federal Tax Lien

Before applying for a certificate of discharge,

3. Attach a copy of each notice of Federal tax

determine how much you owe in order to pay the

lien, or furnish the following information as it

lien(s) in full. You may obtain a payoff by calling

appears on each filed Notice of Federal Tax

1-800-913-6050 or by visiting the nearest IRS

Lien:

Taxpayer Assistance Center. If the amount you

expect to get from the sale of your property is

a. The name of the Internal Revenue Office;

enough to full pay the amount you owe, we will

b. The name and address of the taxpayer

usually not issue a certificate of discharge.

against whom the notice was filed;

There is no standard form available for an

c. The serial number shown on the lien;

application for a Certificate of Discharge of

d. The taxpayer social security number or

Property from a Federal tax lien, a computer-

employer identification number shown on

generated request will be considered as an

the lien; and

application (please no handwritten request).

e. The date and place the notice was filed.

Submit your request and all accompanying

documents in duplicate to:

4.

In lieu of the above, a preliminary title report

may be substituted listing the required informa-

IRS, Attn: Technical Services Group Manager

tion.

(Address to the IRS office in which the lien was filed.

5.

List the encumbrances (or attach a copy of the

Use Publication 4235, Technical Services Addresses, to

instrument that created each encumbrance) on

determine where to mail your request).

the property, which you believe have priority

Information Required on Application

over the Federal tax lien. For each encum-

brance show:

Give date of the application.

a. The name and address of the holder.

b. A description of the encumbrance.

Give the name and address of the person

applying under section 6325(b) of the Internal

c. The date of the agreement.

Revenue Code, for a certificate of discharge. See

d. The date and place of the recording, if any.

the “Additional Information” section of this publica-

e. The original principal amount and the

tion for applicable Internal Revenue Code sections.

interest rate.

Give the name and address of the taxpayer, and

describe the property as follows:

f.

The amount due as of the date of the appli-

cation, if known (show costs and accrued

1. Give a detailed description, including the loca-

interest separately); and

tion of the property for which you are request-

g. Your family relationship, if any, to the

ing the certificate of discharge. If real property

taxpayer and to the holders of any other

is involved, submit a legible copy of the title or

encumbrances on the property.

deed to the property, and the complete address

(street, city, state and ZIP code). If the certifi-

6.

In lieu of the above, a preliminary title report

cate is requested under section 6325(b)(1),

may be substituted listing the required informa-

also give a description of all the taxpayer’s

tion.

remaining property subject to the lien.

7.

Itemize all proposed or actual costs, commis-

2. Show how and when the taxpayer has been or

sions and expenses of any transfer or sale

will be divested of all rights, title and interest in

associated with the property. In lieu of the

and to the property for which a certificate of

above, a proposed closing statement, also

discharge is requested.

known as a preliminary Form HUD-1, may be

submitted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4