Instructions For Form 100-Fee-X - Amended Water'S-Edge Election Fee

ADVERTISEMENT

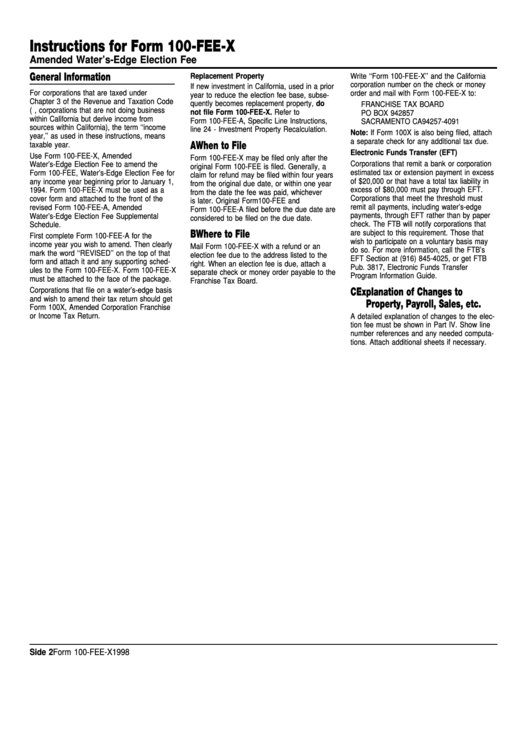

Instructions for Form 100-FEE-X

Amended Water’s-Edge Election Fee

General Information

Replacement Property

Write ‘‘Form 100-FEE-X’’ and the California

corporation number on the check or money

If new investment in California, used in a prior

For corporations that are taxed under

order and mail with Form 100-FEE-X to:

year to reduce the election fee base, subse-

Chapter 3 of the Revenue and Taxation Code

quently becomes replacement property, do

FRANCHISE TAX BOARD

(i.e., corporations that are not doing business

not file Form 100-FEE-X. Refer to

PO BOX 942857

within California but derive income from

Form 100-FEE-A, Specific Line Instructions,

SACRAMENTO CA 94257-4091

sources within California), the term ‘‘income

line 24 - Investment Property Recalculation.

Note: If Form 100X is also being filed, attach

year,’’ as used in these instructions, means

a separate check for any additional tax due.

A When to File

taxable year.

Electronic Funds Transfer (EFT)

Use Form 100-FEE-X, Amended

Form 100-FEE-X may be filed only after the

Corporations that remit a bank or corporation

Water’s-Edge Election Fee to amend the

original Form 100-FEE is filed. Generally, a

estimated tax or extension payment in excess

Form 100-FEE, Water’s-Edge Election Fee for

claim for refund may be filed within four years

of $20,000 or that have a total tax liability in

any income year beginning prior to January 1,

from the original due date, or within one year

excess of $80,000 must pay through EFT.

1994. Form 100-FEE-X must be used as a

from the date the fee was paid, whichever

Corporations that meet the threshold must

cover form and attached to the front of the

is later. Original Form 100-FEE and

remit all payments, including water’s-edge

revised Form 100-FEE-A, Amended

Form 100-FEE-A filed before the due date are

payments, through EFT rather than by paper

Water’s-Edge Election Fee Supplemental

considered to be filed on the due date.

check. The FTB will notify corporations that

Schedule.

B Where to File

are subject to this requirement. Those that

First complete Form 100-FEE-A for the

wish to participate on a voluntary basis may

income year you wish to amend. Then clearly

Mail Form 100-FEE-X with a refund or an

do so. For more information, call the FTB’s

mark the word ‘‘REVISED’’ on the top of that

election fee due to the address listed to the

EFT Section at (916) 845-4025, or get FTB

form and attach it and any supporting sched-

right. When an election fee is due, attach a

Pub. 3817, Electronic Funds Transfer

ules to the Form 100-FEE-X. Form 100-FEE-X

separate check or money order payable to the

Program Information Guide.

must be attached to the face of the package.

Franchise Tax Board.

Corporations that file on a water’s-edge basis

C Explanation of Changes to

and wish to amend their tax return should get

Property, Payroll, Sales, etc.

Form 100X, Amended Corporation Franchise

or Income Tax Return.

A detailed explanation of changes to the elec-

tion fee must be shown in Part IV. Show line

number references and any needed computa-

tions. Attach additional sheets if necessary.

Side 2

Form 100-FEE-X 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1