Presentation - Property Tax Rules Committee - Idaho Association Of County Assessors 105th Annual Conference Page 7

ADVERTISEMENT

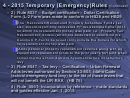

2015 Temporary (Emergency)Rules

Four temporary property tax rules were approved by

the Commission in 2015.

– 1) Rule 626T – Personal property exemption – made Rule

626 conform to the provisions of HB29a

Recovered tax is to be paid to the state and the future

replacement amount is to be reduced if the tax was included

in the original replacement funds calculation

Exempt operating PP set at $100,000 per county not to

exceed the amount reported; and then reduced by any

exemption granted by the assessor.

Most importantly provides that the exempt amount be

subtracted from the Idaho allocated value before the value is

apportioned to the various taxing districts.

For apportionment purposes, the size of railcar companies is

determined after the exemption is applied.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32