Instructions For Schedule Kcr - Kentucky Consolidated Return Schedule (Draft)

ADVERTISEMENT

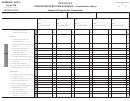

Schedule KCR – Kentucky Consolidated Return Schedule

GENERAL INSTRUCTIONS

Purpose of Form—This schedule must be completed and submitted

with the consolidated income tax return (Form 720) to show the

statutory adjustments for each member of the affiliated group. Each

affiliate should be reported net of all amounts resulting from

transactions with other members of this consolidated group

(intercompany eliminations).

Specific Instructions—For each subsidiary, enter the name, FEIN and

Kentucky Corporation/LLET account number. If there are more than

three subsidiaries in the affiliated group, use Schedule KCR-C,

Kentucky Consolidated Return Schedule Continuation Sheet. For each

line item 1 through 16, the total of the parent plus each subsidiary

shall equal the corresponding line item on Form 720, Part II, if the

affiliate does not have nonbusiness income. Enter on Line 17, the

amount from Schedule A, Section II, Line 3. Enter on Line 18, the

amount from Schedule A, Section II, Line 7. Combine the amounts on

Lines 16 through 18 and enter on Line 19. The total on Line 19 is the

Kentucky net income before apportionment. This is the total of

Schedule A, Part II, Line 4 and Line 7. The total of Line 16 is the same

as the amount on Form 720, Part II, Line 16, unless there is Kentucky

nonbusiness income. This form can be duplicated as needed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1