New Employee Checklist

ADVERTISEMENT

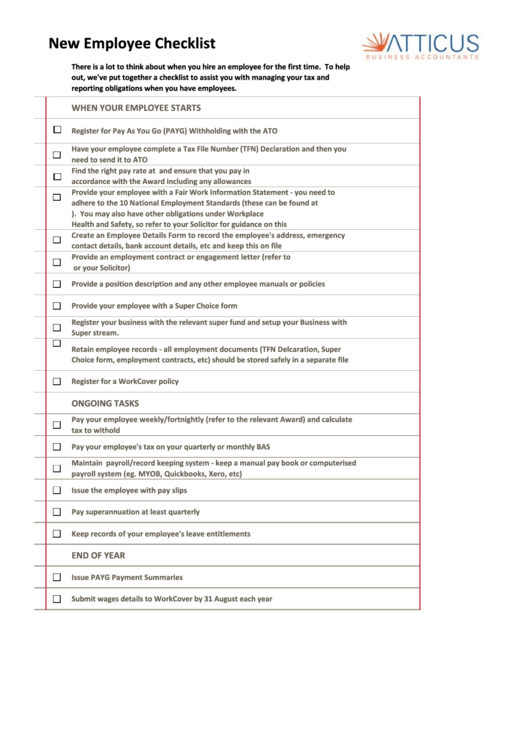

New Employee Checklist

There is a lot to think about when you hire an employee for the first time. To help

out, we've put together a checklist to assist you with managing your tax and

reporting obligations when you have employees.

WHEN YOUR EMPLOYEE STARTS

Register for Pay As You Go (PAYG) Withholding with the ATO

Have your employee complete a Tax File Number (TFN) Declaration and then you

need to send it to ATO

Find the right pay rate at

accordance with the Award including any allowances

Provide your employee with a Fair Work Information Statement ‐ you need to

adhere to the 10 National Employment Standards (these can be found at

). You may also have other obligations under Workplace

Health and Safety, so refer to your Solicitor for guidance on this

Create an Employee Details Form to record the employee's address, emergency

contact details, bank account details, etc and keep this on file

Provide an employment contract or engagement letter (refer to

or your Solicitor)

Provide a position description and any other employee manuals or policies

Provide your employee with a Super Choice form

Register your business with the relevant super fund and setup your Business with

Super stream.

Retain employee records ‐ all employment documents (TFN Delcaration, Super

Choice form, employment contracts, etc) should be stored safely in a separate file

Register for a WorkCover policy

ONGOING TASKS

Pay your employee weekly/fortnightly (refer to the relevant Award) and calculate

tax to withold

Pay your employee's tax on your quarterly or monthly BAS

Maintain payroll/record keeping system ‐ keep a manual pay book or computerised

payroll system (eg. MYOB, Quickbooks, Xero, etc)

Issue the employee with pay slips

Pay superannuation at least quarterly

Keep records of your employee's leave entitlements

END OF YEAR

Issue PAYG Payment Summaries

Submit wages details to WorkCover by 31 August each year

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1