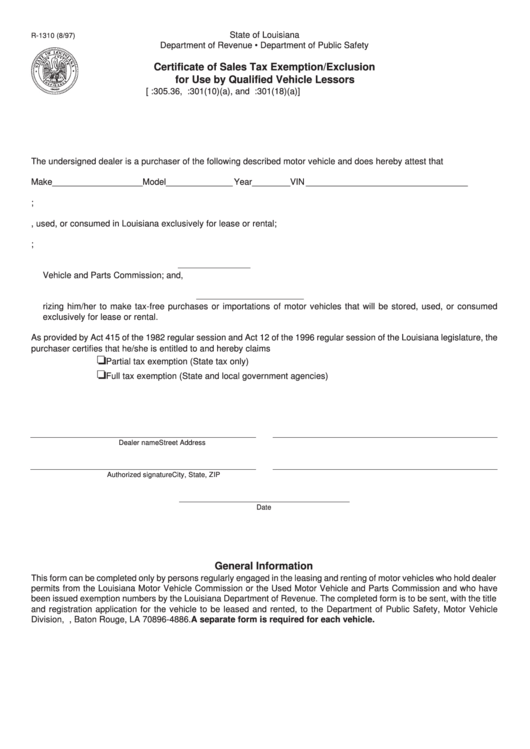

State of Louisiana

R-1310 (8/97)

Department of Revenue • Department of Public Safety

Certificate of Sales Tax Exemption/Exclusion

for Use by Qualified Vehicle Lessors

[R.S. 47:305.36, R.S. 47:301(10)(a), and R.S. 47:301(18)(a)]

The undersigned dealer is a purchaser of the following described motor vehicle and does hereby attest that

Make ___________________ Model ______________ Year ________ VIN __________________________________

1. he/she is engaged in the leasing and renting of motor vehicles to the general public as a regular business activity;

2. the above vehicle will be stored, used, or consumed in Louisiana exclusively for lease or rental;

3. leases and rentals of the vehicle will be at reasonable market rates;

4. he/she holds dealer permit number

from the Louisiana Motor Vehicle Commission or the Used Motor

Vehicle and Parts Commission; and,

5. he/she has received exemption number

from the Louisiana Department of Revenue autho-

rizing him/her to make tax-free purchases or importations of motor vehicles that will be stored, used, or consumed

exclusively for lease or rental.

As provided by Act 415 of the 1982 regular session and Act 12 of the 1996 regular session of the Louisiana legislature, the

purchaser certifies that he/she is entitled to and hereby claims

Partial tax exemption (State tax only)

Full tax exemption (State and local government agencies)

Dealer name

Street Address

Authorized signature

City, State, ZIP

Date

General Information

This form can be completed only by persons regularly engaged in the leasing and renting of motor vehicles who hold dealer

permits from the Louisiana Motor Vehicle Commission or the Used Motor Vehicle and Parts Commission and who have

been issued exemption numbers by the Louisiana Department of Revenue. The completed form is to be sent, with the title

and registration application for the vehicle to be leased and rented, to the Department of Public Safety, Motor Vehicle

Division, P.O. Box 64886, Baton Rouge, LA 70896-4886. A separate form is required for each vehicle.

1

1