Instructions For Form Ct-1120 Att - Corporation Business Tax Return - 2001

ADVERTISEMENT

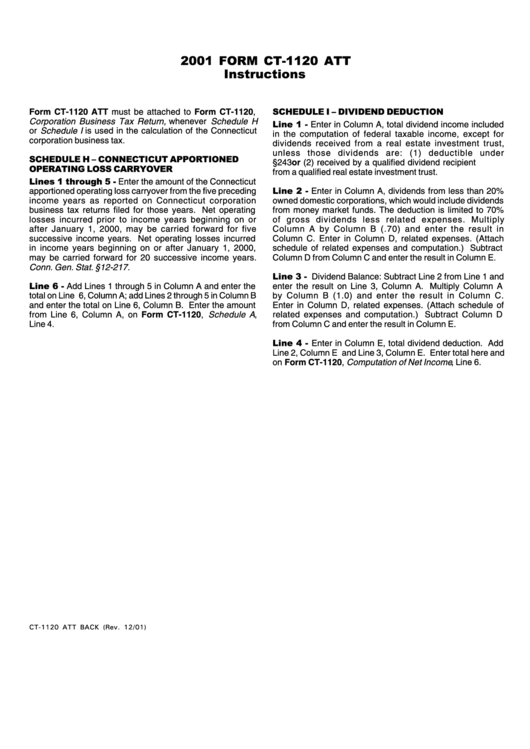

2001 FORM CT-1120 ATT

Instructions

SCHEDULE I – DIVIDEND DEDUCTION

Form CT-1120 ATT must be attached to Form CT-1120,

Corporation Business Tax Return, whenever Schedule H

Line 1 - Enter in Column A, total dividend income included

or Schedule I is used in the calculation of the Connecticut

in the computation of federal taxable income, except for

corporation business tax.

dividends received from a real estate investment trust,

unless those dividends are: (1) deductible under

SCHEDULE H – CONNECTICUT APPORTIONED

I.R.C. §243 or (2) received by a qualified dividend recipient

OPERATING LOSS CARRYOVER

from a qualified real estate investment trust.

Lines 1 through 5 - Enter the amount of the Connecticut

Line 2 - Enter in Column A, dividends from less than 20%

apportioned operating loss carryover from the five preceding

income years as reported on Connecticut corporation

owned domestic corporations, which would include dividends

business tax returns filed for those years. Net operating

from money market funds. The deduction is limited to 70%

losses incurred prior to income years beginning on or

of gross dividends less related expenses. Multiply

after January 1, 2000, may be carried forward for five

Column A by Column B (.70) and enter the result in

successive income years. Net operating losses incurred

Column C. Enter in Column D, related expenses. (Attach

in income years beginning on or after January 1, 2000,

schedule of related expenses and computation.) Subtract

may be carried forward for 20 successive income years.

Column D from Column C and enter the result in Column E.

Conn. Gen. Stat. §12-217.

Line 3 - Dividend Balance: Subtract Line 2 from Line 1 and

Line 6 - Add Lines 1 through 5 in Column A and enter the

enter the result on Line 3, Column A. Multiply Column A

total on Line 6, Column A; add Lines 2 through 5 in Column B

by Column B (1.0) and enter the result in Column C.

and enter the total on Line 6, Column B. Enter the amount

Enter in Column D, related expenses. (Attach schedule of

from Line 6, Column A, on Form CT-1120, Schedule A ,

related expenses and computation.) Subtract Column D

Line 4.

from Column C and enter the result in Column E.

Line 4 - Enter in Column E, total dividend deduction. Add

Line 2, Column E and Line 3, Column E. Enter total here and

on Form CT-1120, Computation of Net Income , Line 6.

CT-1120 ATT BACK (Rev. 12/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1