Form W-1 - Employers Quarterly Return Of Tax Withheld

ADVERTISEMENT

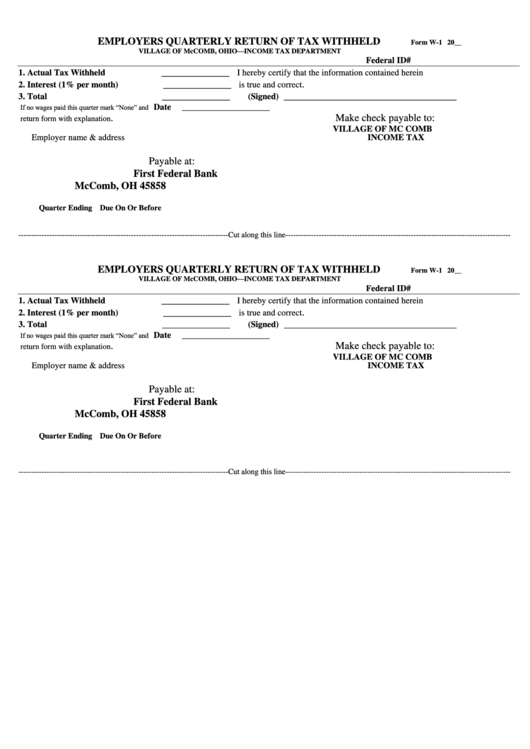

EMPLOYERS QUARTERLY RETURN OF TAX WITHHELD

Form W-1 20__

VILLAGE OF McCOMB, OHIO—INCOME TAX DEPARTMENT

Federal ID#

_____________

1. Actual Tax Withheld

I hereby certify that the information contained herein

_____________

.

2. Interest (1% per month)

is true and correct

_____________

_________________________________

3. Total

(Signed)

If no wages paid this quarter mark “None” and

Date

____________________

.

Make check payable to:

return form with explanation

VILLAGE OF MC COMB

Employer name & address

INCOME TAX

Payable at:

First Federal Bank

McComb, OH 45858

Quarter Ending Due On Or Before

----------------------------------------------------------------------------------Cut along this line----------------------------------------------------------------------------------------

EMPLOYERS QUARTERLY RETURN OF TAX WITHHELD

Form W-1 20__

VILLAGE OF McCOMB, OHIO—INCOME TAX DEPARTMENT

Federal ID#

_____________

1. Actual Tax Withheld

I hereby certify that the information contained herein

_____________

.

2. Interest (1% per month)

is true and correct

_____________

_________________________________

3. Total

(Signed)

If no wages paid this quarter mark “None” and

Date

____________________

.

Make check payable to:

return form with explanation

VILLAGE OF MC COMB

Employer name & address

INCOME TAX

Payable at:

First Federal Bank

McComb, OH 45858

Quarter Ending Due On Or Before

----------------------------------------------------------------------------------Cut along this line----------------------------------------------------------------------------------------

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2