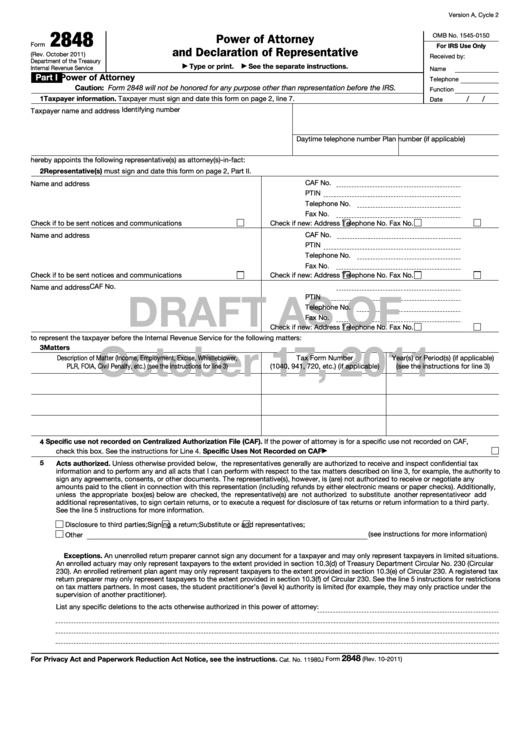

Version A, Cycle 2

2848

Power of Attorney

OMB No. 1545-0150

Form

For IRS Use Only

and Declaration of Representative

(Rev. October 2011)

Received by:

Department of the Treasury

Type or print.

See the separate instructions.

▶

▶

Internal Revenue Service

Name

Part I

Power of Attorney

Telephone

Caution: Form 2848 will not be honored for any purpose other than representation before the IRS.

Function

1 Taxpayer information. Taxpayer must sign and date this form on page 2, line 7.

/

/

Date

Identifying number

Taxpayer name and address

Daytime telephone number

Plan number (if applicable)

hereby appoints the following representative(s) as attorney(s)-in-fact:

2

Representative(s) must sign and date this form on page 2, Part II.

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if to be sent notices and communications

Check if new: Address

Telephone No.

Fax No.

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if to be sent notices and communications

Check if new: Address

Telephone No.

Fax No.

CAF No.

Name and address

DRAFT AS OF

PTIN

Telephone No.

Fax No.

Check if new: Address

Telephone No.

Fax No.

to represent the taxpayer before the Internal Revenue Service for the following matters:

October 17, 2011

3

Matters

Description of Matter (Income, Employment, Excise, Whistleblower,

Tax Form Number

Year(s) or Period(s) (if applicable)

PLR, FOIA, Civil Penalty, etc.) (see the instructions for line 3)

(1040, 941, 720, etc.) (if applicable)

(see the instructions for line 3)

4

Specific use not recorded on Centralized Authorization File (CAF). If the power of attorney is for a specific use not recorded on CAF,

check this box. See the instructions for Line 4. Specific Uses Not Recorded on CAF

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

5

Acts authorized. Unless otherwise provided below, the representatives generally are authorized to receive and inspect confidential tax

information and to perform any and all acts that I can perform with respect to the tax matters described on Iine 3, for example, the authority to

sign any agreements, consents, or other documents. The representative(s), however, is (are) not authorized to receive or negotiate any

amounts paid to the client in connection with this representation (including refunds by either electronic means or paper checks). Additionally,

unless the appropriate box(es) below are checked, the representative(s) are not authorized to substitute another representative or add

additional representatives, to sign certain returns, or to execute a request for disclosure of tax returns or return information to a third party.

See the line 5 instructions for more information.

Disclosure to third parties;

Signing a return;

Substitute or add representatives;

(see instructions for more information)

Other

Exceptions. An unenrolled return preparer cannot sign any document for a taxpayer and may only represent taxpayers in limited situations.

An enrolled actuary may only represent taxpayers to the extent provided in section 10.3(d) of Treasury Department Circular No. 230 (Circular

230). An enrolled retirement plan agent may only represent taxpayers to the extent provided in section 10.3(e) of Circular 230. A registered tax

return preparer may only represent taxpayers to the extent provided in section 10.3(f) of Circular 230. See the line 5 instructions for restrictions

on tax matters partners. In most cases, the student practitioner’s (level k) authority is limited (for example, they may only practice under the

supervision of another practitioner).

List any specific deletions to the acts otherwise authorized in this power of attorney:

2848

For Privacy Act and Paperwork Reduction Act Notice, see the instructions.

Form

(Rev. 10-2011)

Cat. No. 11980J

1

1 2

2