Form Ia W4 - Employee Withholding Allowance Certificate - 2001

ADVERTISEMENT

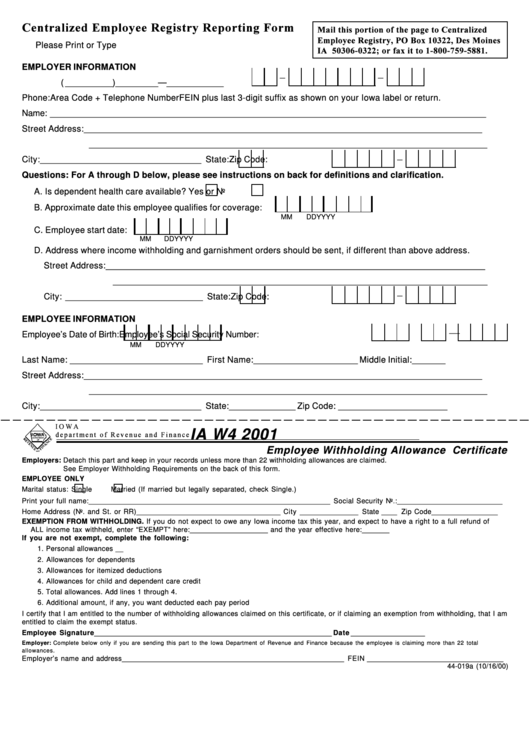

Centralized Employee Registry Reporting Form

Mail this portion of the page to Centralized

Employee Registry, PO Box 10322, Des Moines

Please Print or Type

IA 50306-0322; or fax it to 1-800-759-5881.

EMPLOYER INFORMATION

_

_

( __________ ) _________ — ____________

Phone: Area Code + Telephone Number

FEIN plus last 3-digit suffix as shown on your Iowa label or return.

Name: ____________________________________________________________________________________________

Street Address: ____________________________________________________________________________________

____________________________________________________________________________________

_

City: __________________________________ State:

Zip Code:

Questions: For A through D below, please see instructions on back for definitions and clarification.

A. Is dependent health care available? Yes

or No

B. Approximate date this employee qualifies for coverage:

MM

DD

YYYY

C. Employee start date:

MM

DD

YYYY

D. Address where income withholding and garnishment orders should be sent, if different than above address.

Street Address: ________________________________________________________________________________

_______________________________________________________________________________

_

City: _____________________________ State:

Zip Code:

EMPLOYEE INFORMATION

_

_

Employee’s Date of Birth:

Employee’s Social Security Number:

MM

DD

YYYY

Last Name: ____________________________ First Name: ______________________ Middle Initial: _______

Street Address: ____________________________________________________________________________________

____________________________________________________________________________________

City: __________________________________ State: ______________ Zip Code: _______________________

I O WA

IA W4 2001

d e p a r t m e n t o f R e v e n u e a n d F i n a n c e

Employee Withholding Allowance Certificate

Employers: Detach this part and keep in your records unless more than 22 withholding allowances are claimed.

See Employer Withholding Requirements on the back of this form.

EMPLOYEE ONLY

Marital status:

Single

Married (If married but legally separated, check Single.)

Print your full name: ______________________________________________________________ Social Security No.: ___________________________

Home Address (No. and St. or RR) _____________________________________ City _______________ State ____ Zip Code _________________

EXEMPTION FROM WITHHOLDING. If you do not expect to owe any Iowa income tax this year, and expect to have a right to a full refund of

ALL income tax withheld, enter “EXEMPT” here: ____________________ and the year effective here: _______

If you are not exempt, complete the following:

1. Personal allowances .................................................................................................................. 1. _____________

2. Allowances for dependents ....................................................................................................... 2. _____________

3. Allowances for itemized deductions ......................................................................................... 3. _____________

4. Allowances for child and dependent care credit .................................................................... 4. _____________

5. Total allowances. Add lines 1 through 4. .................................................................................. 5. _____________

6. Additional amount, if any, you want deducted each pay period ........................................... 6. _____________

I certify that I am entitled to the number of withholding allowances claimed on this certificate, or if claiming an exemption from withholding, that I am

entitled to claim the exempt status.

Employee Signature _____________________________________________________________ Date ___________________

Employer: Complete below only if you are sending this part to the Iowa Department of Revenue and Finance because the employee is claiming more than 22 total

allowances.

Employer’s name and address _________________________________________________________ FEIN ___________________________________

44-019a (10/16/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1