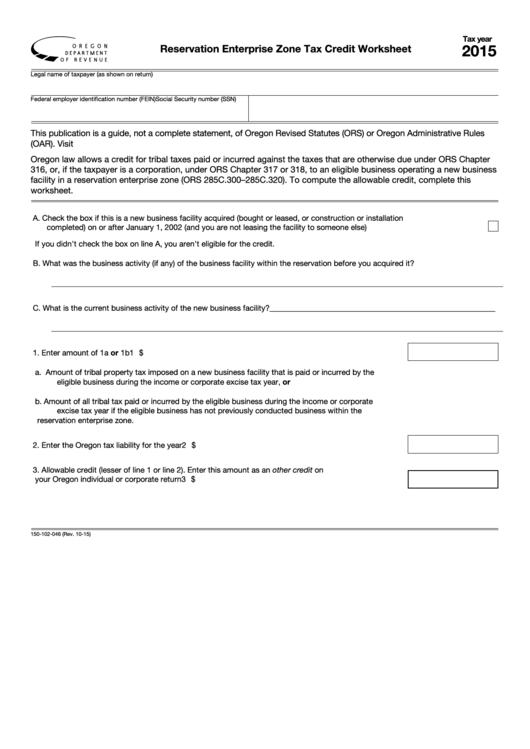

Form 150-102-046 - Reservation Enterprise Zone Tax Credit Worksheet - 2015

ADVERTISEMENT

Tax year

2015

Reservation Enterprise Zone Tax Credit Worksheet

Legal name of taxpayer (as shown on return)

Federal employer identification number (FEIN)

Social Security number (SSN)

This publication is a guide, not a complete statement, of Oregon Revised Statutes (ORS) or Oregon Administrative Rules

(OAR). Visit and sos.oregon.gov.

Oregon law allows a credit for tribal taxes paid or incurred against the taxes that are otherwise due under ORS Chapter

316, or, if the taxpayer is a corporation, under ORS Chapter 317 or 318, to an eligible business operating a new business

facility in a reservation enterprise zone (ORS 285C.300–285C.320). To compute the allowable credit, complete this

worksheet.

A. Check the box if this is a new business facility acquired (bought or leased, or construction or installation

completed) on or after January 1, 2002 (and you are not leasing the facility to someone else) .......................................................

If you didn't check the box on line A, you aren't eligible for the credit.

B. What was the business activity (if any) of the business facility within the reservation before you acquired it?

____________________________________________________________________________________________________________________

C. What is the current business activity of the new business facility?__________________________________________________________

____________________________________________________________________________________________________________________

1. Enter amount of 1a or 1b .......................................................................................................................... 1 $

a. Amount of tribal property tax imposed on a new business facility that is paid or incurred by the

eligible business during the income or corporate excise tax year, or

b. Amount of all tribal tax paid or incurred by the eligible business during the income or corporate

excise tax year if the eligible business has not previously conducted business within the

reservation enterprise zone.

2. Enter the Oregon tax liability for the year .................................................................................................. 2 $

3. Allowable credit (lesser of line 1 or line 2). Enter this amount as an other credit on

your Oregon individual or corporate return ............................................................................................... 3 $

150-102-046 (Rev. 10-15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2