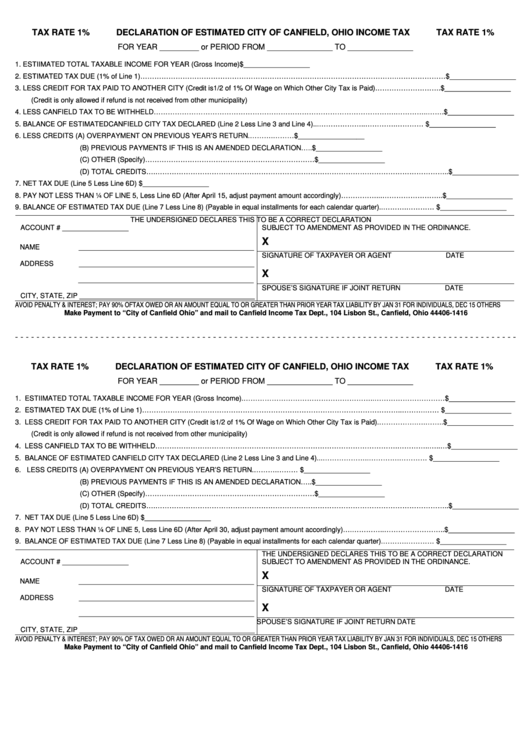

TAX RATE 1%

DECLARATION OF ESTIMATED CITY OF CANFIELD, OHIO INCOME TAX

TAX RATE 1%

FOR YEAR _________ or PERIOD FROM _______________ TO _______________

1. ESTIIMATED TOTAL TAXABLE INCOME FOR YEAR (Gross Income)........................................................................................................$_________________

2. ESTIMATED TAX DUE (1% of Line 1)……………………………………………………………………………………………….…………………$_________________

3. LESS CREDIT FOR TAX PAID TO ANOTHER CITY (Credit is1/2 of 1% Of Wage on Which Other City Tax is Paid)……………………….$_________________

(Credit is only allowed if refund is not received from other municipality)

4. LESS CANFIELD TAX TO BE WITHHELD………………………………………………………………………………………….…………..…….$_________________

5. BALANCE OF ESTIMATED CANFIELD CITY TAX DECLARED (Line 2 Less Line 3 and Line 4)...………………..………….…………........$_________________

6. LESS CREDITS (A) OVERPAYMENT ON PREVIOUS YEAR’S RETURN.……….………........$_________________

(B) PREVIOUS PAYMENTS IF THIS IS AN AMENDED DECLARATION…..$_________________

(C) OTHER (Specify)………………………………………………………………$_________________

(D) TOTAL CREDITS….……………………………………………………………………………………………………………..$_________________

7. NET TAX DUE (Line 5 Less Line 6D).............................................................................................................................................................$_________________

8. PAY NOT LESS THAN ¼ OF LINE 5, Less Line 6D (After April 15, adjust payment amount accordingly)……………...……………………..$_________________

9. BALANCE OF ESTIMATED TAX DUE (Line 7 Less Line 8) (Payable in equal installments for each calendar quarter)..……….…………....$_________________

THE UNDERSIGNED DECLARES THIS TO BE A CORRECT DECLARATION

ACCOUNT # _________________

SUBJECT TO AMENDMENT AS PROVIDED IN THE ORDINANCE.

X

NAME

_____________________________________________

SIGNATURE OF TAXPAYER OR AGENT

DATE

ADDRESS

_____________________________________________

X

_____________________________________________

SPOUSE’S SIGNATURE IF JOINT RETURN

DATE

CITY, STATE, ZIP _____________________________________________

AVOID PENALTY & INTEREST; PAY 90% OF TAX OWED OR AN AMOUNT EQUAL TO OR GREATER THAN PRIOR YEAR TAX LIABILITY BY JAN 31 FOR INDIVIDUALS, DEC 15 OTHERS

Make Payment to “City of Canfield Ohio” and mail to Canfield Income Tax Dept., 104 Lisbon St., Canfield, Ohio 44406-1416

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

TAX RATE 1%

DECLARATION OF ESTIMATED CITY OF CANFIELD, OHIO INCOME TAX

TAX RATE 1%

FOR YEAR _________ or PERIOD FROM _______________ TO _______________

1. ESTIIMATED TOTAL TAXABLE INCOME FOR YEAR (Gross Income).………………………………………………..…………………………$_________________

2. ESTIMATED TAX DUE (1% of Line 1)……………….………………………………………………………………………………..……….……....$_________________

3. LESS CREDIT FOR TAX PAID TO ANOTHER CITY (Credit is1/2 of 1% Of Wage on Which Other City Tax is Paid).…………….….……..$_________________

(Credit is only allowed if refund is not received from other municipality)

4. LESS CANFIELD TAX TO BE WITHHELD………………………………………………………………………………………….…………..…..…$_________________

5. BALANCE OF ESTIMATED CANFIELD CITY TAX DECLARED (Line 2 Less Line 3 and Line 4)...………………..………….………….........$_________________

6. LESS CREDITS (A) OVERPAYMENT ON PREVIOUS YEAR’S RETURN.……….………........$_________________

(B) PREVIOUS PAYMENTS IF THIS IS AN AMENDED DECLARATION…..$_________________

(C) OTHER (Specify)………………………………………………………………$_________________

(D) TOTAL CREDITS….……………………………………………………………………………………………………………..$_________________

7. NET TAX DUE (Line 5 Less Line 6D).............................................................................................................................................................$_________________

8. PAY NOT LESS THAN ¼ OF LINE 5, Less Line 6D (After April 30, adjust payment amount accordingly)….…………..……………………..$_________________

9. BALANCE OF ESTIMATED TAX DUE (Line 7 Less Line 8) (Payable in equal installments for each calendar quarter).……….…………....$_________________

THE UNDERSIGNED DECLARES THIS TO BE A CORRECT DECLARATION

ACCOUNT # _________________

SUBJECT TO AMENDMENT AS PROVIDED IN THE ORDINANCE.

X

NAME

_____________________________________________

SIGNATURE OF TAXPAYER OR AGENT

DATE

ADDRESS

_____________________________________________

X

_____________________________________________

SPOUSE’S SIGNATURE IF JOINT RETURN

DATE

CITY, STATE, ZIP _____________________________________________

AVOID PENALTY & INTEREST; PAY 90% OF TAX OWED OR AN AMOUNT EQUAL TO OR GREATER THAN PRIOR YEAR TAX LIABILITY BY JAN 31 FOR INDIVIDUALS, DEC 15 OTHERS

Make Payment to “City of Canfield Ohio” and mail to Canfield Income Tax Dept., 104 Lisbon St., Canfield, Ohio 44406-1416

1

1