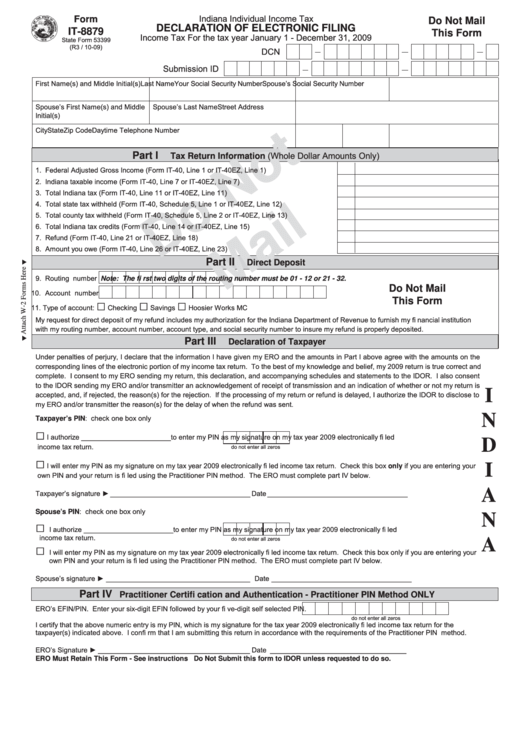

Indiana Individual Income Tax

Form

Do Not Mail

DECLARATION OF ELECTRONIC FILING

IT-8879

This Form

Income Tax For the tax year January 1 - December 31, 2009

State Form 53399

(R3 / 10-09)

DCN

Submission ID

First Name(s) and Middle Initial(s)

Last Name

Your Social Security Number Spouse’s Social Security Number

Spouse’s First Name(s) and Middle

Spouse’s Last Name

Street Address

Initial(s)

City

State

Zip Code

Daytime Telephone Number

Tax Return Information (Whole Dollar Amounts Only)

Part I

1. Federal Adjusted Gross Income (Form IT-40, Line 1 or IT-40EZ, Line 1) ...................................

1.

2. Indiana taxable income (Form IT-40, Line 7 or IT-40EZ, Line 7) .................................................

2.

3. Total Indiana tax (Form IT-40, Line 11 or IT-40EZ, Line 11) ........................................................

3.

4. Total state tax withheld (Form IT-40, Schedule 5, Line 1 or IT-40EZ, Line 12) ...........................

4.

5. Total county tax withheld (Form IT-40, Schedule 5, Line 2 or IT-40EZ, Line 13) .........................

5.

6. Total Indiana tax credits (Form IT-40, Line 14 or IT-40EZ, Line 15) ............................................

6.

7. Refund (Form IT-40, Line 21 or IT-40EZ, Line 18) ......................................................................

7.

8. Amount you owe (Form IT-40, Line 26 or IT-40EZ, Line 23) .......................................................

8.

Part II

Direct Deposit

9. Routing number

Note: The fi rst two digits of the routing number must be 01 - 12 or 21 - 32.

Do Not Mail

10. Account number

□

□

□

This Form

11. Type of account:

Checking

Savings

Hoosier Works MC

My request for direct deposit of my refund includes my authorization for the Indiana Department of Revenue to furnish my fi nancial institution

with my routing number, account number, account type, and social security number to insure my refund is properly deposited.

Part III

Declaration of Taxpayer

Under penalties of perjury, I declare that the information I have given my ERO and the amounts in Part I above agree with the amounts on the

corresponding lines of the electronic portion of my income tax return. To the best of my knowledge and belief, my 2009 return is true correct and

complete. I consent to my ERO sending my return, this declaration, and accompanying schedules and statements to the IDOR. I also consent

to the IDOR sending my ERO and/or transmitter an acknowledgement of receipt of transmission and an indication of whether or not my return is

I

accepted, and, if rejected, the reason(s) for the rejection. If the processing of my return or refund is delayed, I authorize the IDOR to disclose to

my ERO and/or transmitter the reason(s) for the delay of when the refund was sent.

N

Taxpayer’s PIN: check one box only

□

I authorize _______________________ to enter my PIN

as my signature on my tax year 2009 electronically fi led

D

income tax return.

do not enter all zeros

□

I will enter my PIN as my signature on my tax year 2009 electronically fi led income tax return. Check this box only if you are entering your

I

own PIN and your return is fi led using the Practitioner PIN method. The ERO must complete part IV below.

A

Taxpayer’s signature ► ____________________________________ Date ____________________________________

Spouse’s PIN: check one box only

N

□

I authorize _______________________ to enter my PIN

as my signature on my tax year 2009 electronically fi led

income tax return.

do not enter all zeros

A

□

I will enter my PIN as my signature on my tax year 2009 electronically fi led income tax return. Check this box only if you are entering your

own PIN and your return is fi led using the Practitioner PIN method. The ERO must complete part IV below.

Spouse’s signature ► _____________________________________ Date ____________________________________

Part IV

Practitioner Certifi cation and Authentication - Practitioner PIN Method ONLY

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your fi ve-digit self selected PIN.

do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the tax year 2009 electronically fi led income tax return for the

taxpayer(s) indicated above. I confi rm that I am submitting this return in accordance with the requirements of the Practitioner PIN method.

ERO’s Signature ► _______________________________________ Date ___________________________________

ERO Must Retain This Form - See instructions Do Not Submit this form to IDOR unless requested to do so.

1

1