Form Ar1155 - Request For Arkansas Extension Of Time For Filing Income Tax Returns - 2017

ADVERTISEMENT

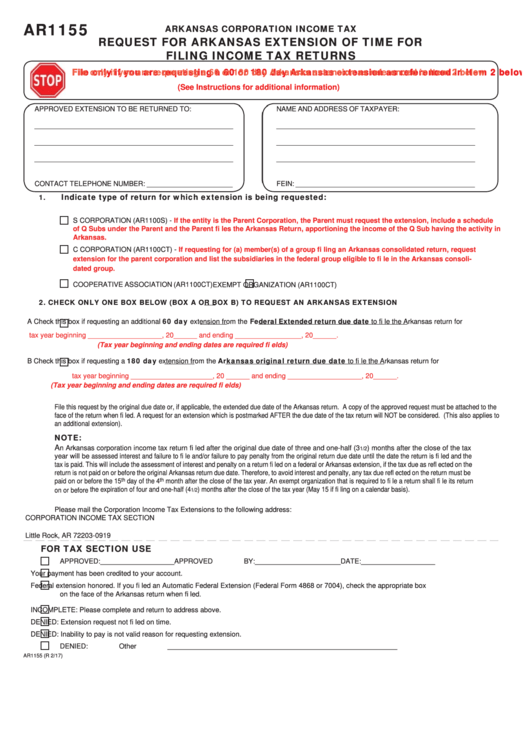

AR1155

ARKANSAS CORPORATION INCOME TAX

REQUEST FOR ARKANSAS EXTENSION OF TIME FOR

FILING INCOME TAX RETURNS

File only if you are requesting a 60 or 180 day Arkansas extension as referenced in Item 2 below

File only if you are requesting a 60 or 180 day Arkansas extension as referenced in Item 2 below

(See Instructions for additional information)

APPROVED EXTENSION TO BE RETURNED TO:

NAME AND ADDRESS OF TAXPAYER:

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

CONTACT TELEPHONE NUMBER: ______________________

FEIN: ______________________________________________

Indicate type of return for which extension is being requested:

1.

S CORPORATION (AR1100S) -

If the entity is the Parent Corporation, the Parent must request the extension, include a schedule

of Q Subs under the Parent and the Parent fi les the Arkansas Return, apportioning the income of the Q Sub having the activity in

Arkansas.

C CORPORATION (AR1100CT) -

If requesting for (a) member(s) of a group fi ling an Arkansas consolidated return, request

extension for the parent corporation and list the subsidiaries in the federal group eligible to fi le in the Arkansas consoli-

dated group.

COOPERATIVE ASSOCIATION (AR1100CT)

EXEMPT ORGANIZATION (AR1100CT)

2.

CHECK ONLY ONE BOX BELOW (BOX A OR BOX B) TO REQUEST AN ARKANSAS EXTENSION

Check this box if requesting an additional 60 day extension from the Federal Extended return due date to fi le the Arkansas return for

A

tax year beginning ___________________, 20______ and ending _________________, 20______.

(Tax year beginning and ending dates are required fi elds)

Check this box if requesting a 180 day extension from the Arkansas original return due date to fi le the Arkansas return for

B

tax year beginning _____________________, 20 ______ and ending ___________________, 20______.

(Tax year beginning and ending dates are required fi elds)

File this request by the original due date or, if applicable, the extended due date of the Arkansas return. A copy of the approved request must be attached to the

face of the return when fi led. A request for an extension which is postmarked AFTER the due date of the tax return will NOT be considered. (This also applies to

an additional extension).

NOTE:

A

n Arkansas corporation income tax return fi led after the original due date of three and one-half (3

) months after the close of the tax

1/2

year will be assessed interest and failure to fi le and/or failure to pay penalty from the original return due date until the date the return is fi led and the

tax is paid. This will include the assessment of interest and penalty on a return fi led on a federal or Arkansas extension, if the tax due as refl ected on the

return is not paid on or before the original Arkansas return due date. Therefore, to avoid interest and penalty, any tax due refl ected on the return must be

th

th

paid on or before the 15

day of the 4

month after the close of the tax year. An exempt organization that is required to fi le a return shall fi le its return

on or before the expiration of four and one-half (4

) months after the close of the tax year (May 15 if fi ling on a calendar basis).

1/2

Please mail the Corporation Income Tax Extensions to the following address:

CORPORATION INCOME TAX SECTION

P.O. Box 919

Little Rock, AR 72203-0919

FOR TAX SECTION USE

APPROVED:___________________APPROVED BY:______________________DATE:___________________

Your payment has been credited to your account.

Federal extension honored. If you fi led an Automatic Federal Extension (Federal Form 4868 or 7004), check the appropriate box

on the face of the Arkansas return when fi led.

INCOMPLETE: Please complete and return to address above.

DENIED: Extension request not fi led on time.

DENIED: Inability to pay is not valid reason for requesting extension.

DENIED: Other ___________________________________________________________

AR1155 (R 2/17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2