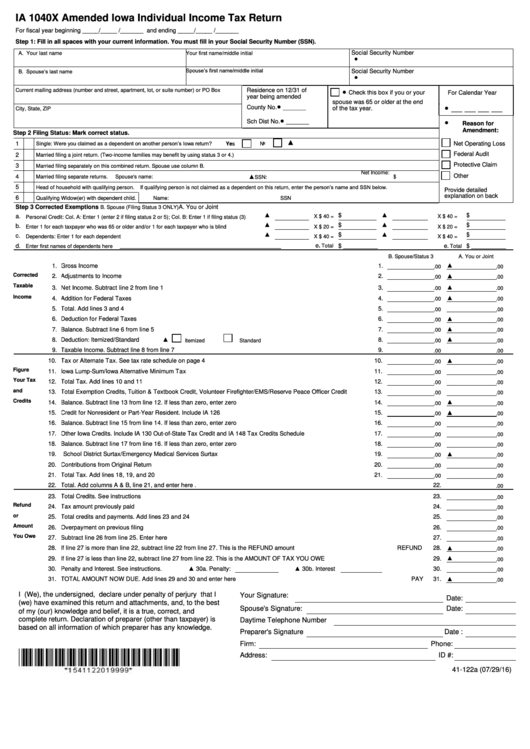

IA 1040X Amended Iowa Individual Income Tax Return

For fiscal year beginning _____/_____ /_______ and ending _____/_____ /_______

Step 1: Fill in all spaces with your current information. You must fill in your Social Security Number (SSN).

Social Security Number

A. Your last name

Your first name/middle initial

•

B. Spouse’s last name

Spouse’s first name/middle initial

Social Security Number

•

•

Residence on 12/31 of

Current mailing address (number and street, apartment, lot, or suite number) or PO Box

Check this box if you or your

For Calendar Year

year being amended

spouse was 65 or older at the end

•

•

__ __ __ __

County No.

_______

City, State, ZIP

of the tax year.

•

•

Sch Dist No.

_______

Reason for

Amendment:

Step 2 Filing Status: Mark correct status.

▲

Single: Were you claimed as a dependent on another person’s Iowa return?

Net Operating Loss

1

Yes

No

Federal Audit

2

Married filing a joint return. (Two-income families may benefit by using status 3 or 4.)

Protective Claim

3

Married filing separately on this combined return. Spouse use column B.

▲

Other

4

Married filing separate returns.

Spouse's name:

Net Income: $

SSN:

If qualifying person is not claimed as a dependent on this return, enter the person’s name and SSN below.

5

Head of household with qualifying person.

Provide detailed

explanation on back

6

Qualifying Widow(er) with dependent child.

Name:

SSN

Step 3 Corrected Exemptions

A. You or Joint

B. Spouse (Filing Status 3 ONLY)

▲

$

▲

$

a.

Personal Credit: Col. A: Enter 1 (enter 2 if filing status 2 or 5); Col. B: Enter 1 if filing status (3) ........................

X $ 40 =

X $ 40 =

▲

$

▲

$

b.

Enter 1 for each taxpayer who was 65 or older and/or 1 for each taxpayer who is blind .....................................

X $ 20 =

X $ 20 =

▲

$

▲

$

c.

Dependents: Enter 1 for each dependent.............................................................................................................

X $ 40 =

X $ 40 =

d.

e.

$ _______________

e.

$ ______________

Enter first names of dependents here

_______________________________________________________________

Total

Total

B. Spouse/Status 3

A. You or Joint

▲

1. Gross Income ...........................................................................................................................................................................

1.

.00

.00

Corrected

▲

2. Adjustments to Income ............................................................................................................................................................

2.

.00

.00

Taxable

▲

3. Net Income. Subtract line 2 from line 1 .........................................................................................................................

3.

.00

.00

Income

▲

4. Addition for Federal Taxes .....................................................................................................................................................

4.

.00

.00

5. Total. Add lines 3 and 4 .................................................................................................................................................

5.

.00

.00

▲

6. Deduction for Federal Taxes ..................................................................................................................................................

6.

.00

.00

▲

7. Balance. Subtract line 6 from line 5 ..............................................................................................................................

7.

.00

.00

▲

▲

8. Deduction: Itemized/Standard

8.

Itemized

Standard ..............................................................................................

.00

.00

9. Taxable Income. Subtract line 8 from line 7 ...........................................................................................................................................

9.

.00

.00

▲

10. Tax or Alternate Tax. See tax rate schedule on page 4 .........................................................................................................

10.

.00

.00

Figure

11. Iowa Lump-Sum/Iowa Alternative Minimum Tax .................................................................................................................

11.

.00

.00

Your Tax

12. Total Tax. Add lines 10 and 11 ......................................................................................................................................

12.

.00

.00

and

13. Total Exemption Credits, Tuition & Textbook Credit, Volunteer Firefighter/EMS/Reserve Peace Officer Credit .... 13.

.00

.00

Credits

▲

14. Balance. Subtract line 13 from line 12. If less than zero, enter zero ............................................................................

14.

.00

.00

▲

15. Credit for Nonresident or Part-Year Resident. Include IA 126 ......................................................................................

15.

.00

.00

16. Balance. Subtract line 15 from line 14. If less than zero, enter zero ............................................................................

16.

.00

.00

17. Other Iowa Credits. Include IA 130 Out-of-State Tax Credit and IA 148 Tax Credits Schedule .....................................

17.

.00

.00

18. Balance. Subtract line 17 from line 16. If less than zero, enter zero ............................................................................

18.

.00

.00

▲

19. School District Surtax/Emergency Medical Services Surtax ........................................................................................

19.

.00

.00

20. Contributions from Original Return ................................................................................................................................

20.

.00

.00

21. Total Tax. Add lines 18, 19, and 20 ...............................................................................................................................

21.

.00

.00

22. Total. Add columns A & B, line 21, and enter here ................................................................................................................................. 22.

.00

23. Total Credits. See instructions .......................................................................................................................................................................................................................

23.

.00

Refund

24. Tax amount previously paid ...........................................................................................................................................................................................................................

24.

.00

or

25. Total credits and payments. Add lines 23 and 24 ..........................................................................................................................................................................................

25.

.00

Amount

26. Overpayment on previous filing ....................................................................................................................................................................................................................................

26.

.00

You Owe

27. Subtract line 26 from line 25. Enter here ........................................................................................................................................................................................................

27.

.00

28. ▲

28. If line 27 is more than line 22, subtract line 22 from line 27. This is the REFUND amount ..........................................................

REFUND

.00

29. ▲

29. If line 27 is less than line 22, subtract line 27 from line 22. This is the AMOUNT OF TAX YOU OWE .........................................................................................................

.00

▲ 30a. Penalty:

▲ 30b. Interest

30. Penalty and Interest. See instructions.

30.

........................................

.00

31. ▲

31. TOTAL AMOUNT NOW DUE. Add lines 29 and 30 and enter here..............................................................................................................

PAY

.00

I (We), the undersigned, declare under penalty of perjury that I

Your Signature:

Date:

(we) have examined this return and attachments, and, to the best

Spouse's Signature:

Date:

of my (our) knowledge and belief, it is a true, correct, and

complete return. Declaration of preparer (other than taxpayer) is

Daytime Telephone Number

based on all information of which preparer has any knowledge.

Preparer's Signature

Date :

Firm:

Phone:

Address:

ID #:

41-122a (07/29/16)

1

1 2

2