Reset Form

2002

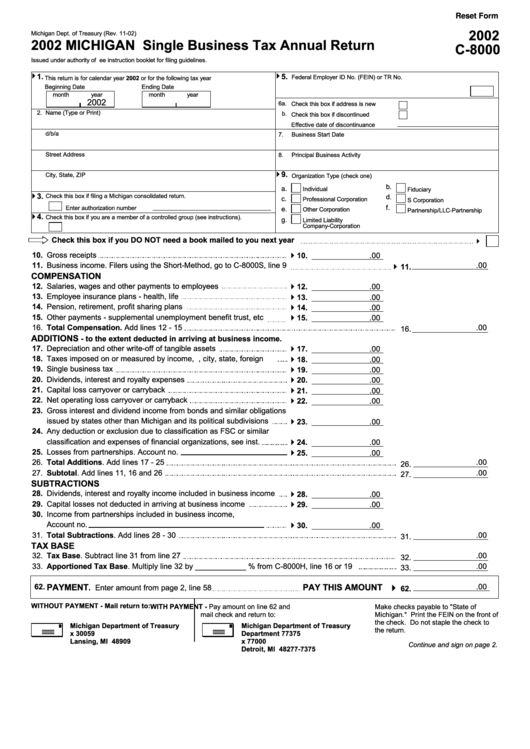

Michigan Dept. of Treasury (Rev. 11-02)

2002 MICHIGAN Single Business Tax Annual Return

C-8000

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

4

4

1.

5.

Federal Employer ID No. (FEIN) or TR No.

This return is for calendar year 2002 or for the following tax year

Beginning Date

Ending Date

month

year

month

year

2002

6a.

Check this box if address is new

2.

Name (Type or Print)

b.

Check this box if discontinued

Effective date of discontinuance

d/b/a

7.

Business Start Date

Street Address

8.

Principal Business Activity

4

9.

City, State, ZIP

Organization Type (check one)

b.

a.

Individual

Fiduciary

4

3.

Check this box if filing a Michigan consolidated return.

d.

c.

Professional Corporation

S Corporation

f.

Enter authorization number

e.

Other Corporation

Partnership/LLC-Partnership

4

4.

Check this box if you are a member of a controlled group (see instructions).

g.

Limited Liability

Company-Corporation

Check this box if you DO NOT need a book mailed to you next year

4

4

10.

Gross receipts

10.

.00

11.

Business income. Filers using the Short-Method, go to C-8000S, line 9

.00

4

11.

COMPENSATION

12.

Salaries, wages and other payments to employees

4

12.

.00

4

13.

Employee insurance plans - health, life

13.

.00

4

14.

Pension, retirement, profit sharing plans

14.

.00

15.

Other payments - supplemental unemployment benefit trust, etc

4

15.

.00

16.

Total Compensation. Add lines 12 - 15

.00

16.

ADDITIONS

- to the extent deducted in arriving at business income.

4

17.

Depreciation and other write-off of tangible assets

17.

.00

4

18.

Taxes imposed on or measured by income, e.g., city, state, foreign

18.

.00

19.

Single business tax

4

19.

.00

4

20.

Dividends, interest and royalty expenses

20.

.00

4

21.

Capital loss carryover or carryback

21.

.00

22.

Net operating loss carryover or carryback

4

22.

.00

23.

Gross interest and dividend income from bonds and similar obligations

4

issued by states other than Michigan and its political subdivisions

23.

.00

24.

Any deduction or exclusion due to classification as FSC or similar

4

classification and expenses of financial organizations, see inst.

24.

.00

25.

Losses from partnerships. Account no.

4

25.

.00

26.

Total Additions. Add lines 17 - 25

.00

26.

27.

Subtotal. Add lines 11, 16 and 26

.00

27.

SUBTRACTIONS

4

28.

Dividends, interest and royalty income included in business income

28.

.00

4

29.

Capital losses not deducted in arriving at business income

29.

.00

30.

Income from partnerships included in business income,

4

Account no.

30.

.00

31.

Total Subtractions. Add lines 28 - 30

.00

31.

TAX BASE

32.

Tax Base. Subtract line 31 from line 27

.00

32.

33.

Apportioned Tax Base. Multiply line 32 by ____________ % from C-8000H, line 16 or 19

.00

33.

4

62.

PAYMENT

PAY THIS AMOUNT

.00

. Enter amount from page 2, line 58

62.

WITHOUT PAYMENT - Mail return to:

WITH PAYMENT - Pay amount on line 62 and

Make checks payable to "State of

mail check and return to:

Michigan." Print the FEIN on the front of

the check. Do not staple the check to

Michigan Department of Treasury

Michigan Department of Treasury

the return.

P.O. Box 30059

Department 77375

Lansing, MI 48909

P.O. Box 77000

Continue and sign on page 2.

Detroit, MI 48277-7375

1

1 2

2