Wyoming Internet Filing Service Electronic Filing Agreement Form

ADVERTISEMENT

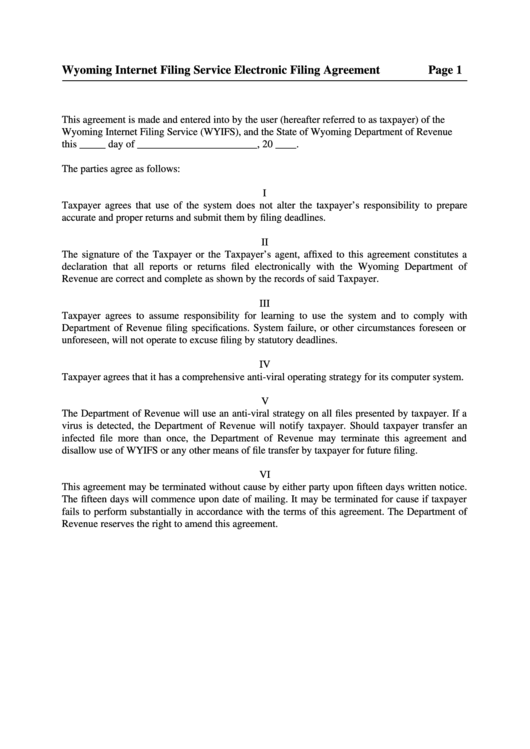

Wyoming Internet Filing Service Electronic Filing Agreement

Page 1

This agreement is made and entered into by the user (hereafter referred to as taxpayer) of the

Wyoming Internet Filing Service (WYIFS), and the State of Wyoming Department of Revenue

this _____ day of _______________________, 20 ____.

The parties agree as follows:

I

Taxpayer agrees that use of the system does not alter the taxpayer’s responsibility to prepare

accurate and proper returns and submit them by filing deadlines.

II

The signature of the Taxpayer or the Taxpayer’s agent, affixed to this agreement constitutes a

declaration that all reports or returns filed electronically with the Wyoming Department of

Revenue are correct and complete as shown by the records of said Taxpayer.

III

Taxpayer agrees to assume responsibility for learning to use the system and to comply with

Department of Revenue filing specifications. System failure, or other circumstances foreseen or

unforeseen, will not operate to excuse filing by statutory deadlines.

IV

Taxpayer agrees that it has a comprehensive anti-viral operating strategy for its computer system.

V

The Department of Revenue will use an anti-viral strategy on all files presented by taxpayer. If a

virus is detected, the Department of Revenue will notify taxpayer. Should taxpayer transfer an

infected file more than once, the Department of Revenue may terminate this agreement and

disallow use of WYIFS or any other means of file transfer by taxpayer for future filing.

VI

This agreement may be terminated without cause by either party upon fifteen days written notice.

The fifteen days will commence upon date of mailing. It may be terminated for cause if taxpayer

fails to perform substantially in accordance with the terms of this agreement. The Department of

Revenue reserves the right to amend this agreement.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5