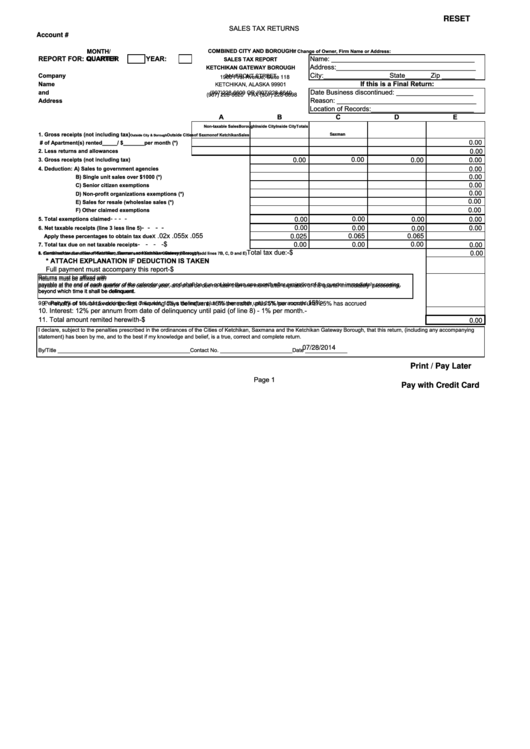

RESET

SALES TAX RETURNS

Account #

COMBINED CITY AND BOROUGH

If Change of Owner, Firm Name or Address:

MONTH/

REPORT FOR: QUARTER

YEAR:

Name: _______________________________________

QUARTER

SALES TAX REPORT

Address:______________________________________

KETCHIKAN GATEWAY BOROUGH

City:__________________State_______Zip _________

Company

344 FRONT STREET

1900 First Avenue, Suite 118

If this is a Final Return:

Name

KETCHIKAN, ALASKA 99901

Date Business discontinued: _____________________

and

(907)228-6609 OR (907)228-6640

(907) 228-6620 FAX (907) 228-6698

Reason: ______________________________________

Address

Location of Records:____________________________

A

B

C

D

E

Non-taxable Sales

Borough

Inside City

Inside City

Totals

1. Gross receipts (not including tax)

Saxman

Outside Cities

of Saxmon

of Ketchikan

Sales

Outside City & Borough

# of Apartment(s) rented_____/ $_______per month (*)

0.00

2. Less returns and allowances

0.00

3. Gross receipts (not including tax)

0.00

0.00

0.00

0.00

4. Deduction: A) Sales to government agencies

0.00

B) Single unit sales over $1000 (*)

0.00

C) Senior citizen exemptions

0.00

D) Non-profit organizations exemptions (*)

0.00

E) Sales for resale (wholeslae sales (*)

0.00

F) Other claimed exemptions

0.00

-

-

-

-

5. Total exemptions claimed

0.00

0.00

0.00

0.00

-

-

-

-

6. Net taxable receipts (line 3 less line 5)

0.00

0.00

0.00

0.00

x .02

x .055

x .055

Apply these percentages to obtain tax due

0.025

0.065

0.065

-

-

-

$

-

7. Total tax due on net taxable receipts

0.00

0.00

0.00

0.00

Total tax due:

$

-

0.00

8. Combined tax due cities of Ketchikan, Sasman and Ketchikan Gateway Borough (add lines 7B, C, D and E)

8. Combined tax due cities of Ketchikan, Saxman, and Ketchikan Gateway Borough

* ATTACH EXPLANATION IF DEDUCTION IS TAKEN

Full payment must accompany this report

$

-

Returns must be affixed with U.S. Postal mark on or before the last day of the month following the last month of eash quarter. The tax imposed shall be

Returns must be affixed with U.S. Postal mark on or before the last day of the month following the last month of each quarter. The tax imposed shall be

payable at the end of each quarter of the calendar year, and shall be due not later than one month after expiration of the quarter immediately preceeing,

payable at the end of each quarter of the calendar year, and shall be due no later than one month after expiration of the quarter immediately preceeding,

beyond which time it shall be delinquent.

beyond which time it shall be delinquent.

15%

-

9. Penalty 6% of tax due 5 workings days deliquent, 15% a thereafter, plus 5% per month until 25% has accrued.

9. Penalty of 1% of tax due the first 7 working days delinquent, 15% thereafter, plus 5% per month until 25% has accrued

10. Interest: 12% per annum from date of delinquency until paid (of line 8) - 1% per month.

-

11. Total amount remited herewith

$

-

0.00

I declare, subject to the penalties prescribed in the ordinances of the Cities of Ketchikan, Saxmana and the Ketchikan Gateway Borough, that this return, (including any accompanying

statement) has been by me, and to the best if my knowledge and belief, is a true, correct and complete return.

07/28/2014

By/Title ____________________________________________Contact No. ________________________Date ______________

Print / Pay Later

Page 1

Pay with Credit Card

1

1 2

2