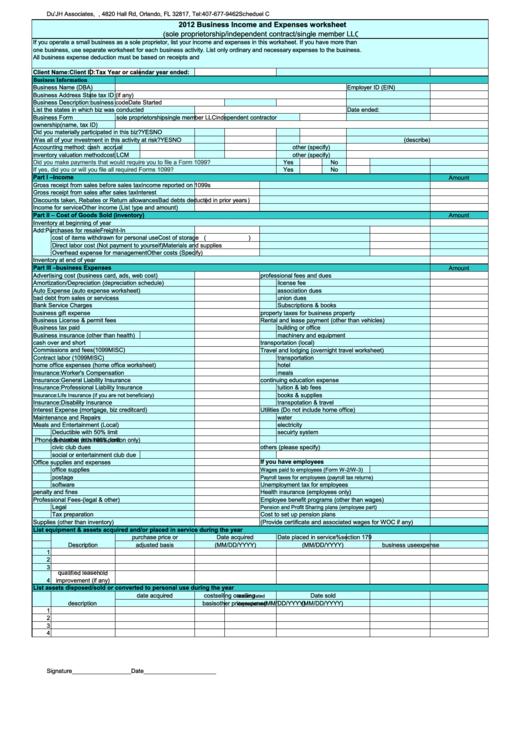

Business Income And Expenses Worksheet

ADVERTISEMENT

Du'JH Associates, P.A., 4820 Hall Rd, Orlando, FL 32817, Tel:407-677-9462

Scheduel C worksheet.xls

2012 Business Income and Expenses worksheet

(sole proprietorship/independent contract/single member LLC

If you operate a small business as a sole proprietor, list your income and expenses in this worksheet. If you have more than

one business, use separate worksheet for each business activity. List only ordinary and necessary expenses to the business.

All business expense deduction must be based on receipts and records.Do not list personal expense in the worksheet.

Client Name:

Client ID:

Tax Year or calendar year ended:

Business Information

Business Name (DBA)

Employer ID (EIN)

Business Address

State tax ID (if any)

Business Description:

business code

Date Started

List the states in which biz was conducted

Date ended:

Business Form

sole proprietorship

single member LLC

independent contractor

ownership(name, tax ID)

Did you materially participated in this biz?

YES

NO

Was all of your investment in this activity at risk?

YES

NO

(describe)

Accounting method:

cash

accrual

other (specify)

inventory valuation method

cost

LCM

other (specify)

Did you make payments that would require you to file a Form 1099?

Yes

No

If yes, did you or will you file all required Forms 1099?

Yes

No

Part I –Income

Amount

Gross receipt from sales before sales tax

Income reported on 1099s

Gross receipt from sales after sales tax

Interest

Discounts taken, Rebates or Return allowances

(

)

Bad debts deducted in prior years

Income for service

Other income (List type and amount)

Part II – Cost of Goods Sold (inventory)

Amount

Inventory at beginning of year

Add:

Purchases for resale

Freight-In

cost of items withdrawn for personal use

(

)

Cost of storage

Direct labor cost (Not payment to yourself)

Materials and supplies

Overhead expense for management

Other costs (Specify)

Inventory at end of year

Part III –business Expenses

Amount

Advertising cost (business card, ads, web cost)

professional fees and dues

Amortization/Depreciation (depreciation schedule)

license fee

Auto Expense (auto expense worksheet)

association dues

bad debt from sales or servicess

union dues

Bank Service Charges

Subscriptions & books

business gift expense

property taxes for business property

Business License & permit fees

Rental and lease payment (other than vehicles)

Business tax paid

building or office

Business insurance (other than health)

machinery and equipment

cash over and short

transportation (local)

Commissions and fees(1099MISC)

Travel and lodging (overnight travel worksheet)

Contract labor (1099MISC)

transportation

home office expenses (home office worksheet)

hotel

Insurance:Worker's Compensation

meals

Insurance:General Liability Insurance

continuing education expense

Insurance:Professional Liability Insurance

tuition & lab fees

books & supplies

Insurance:Life Insurance (if you are not beneficiary)

Insurance:Disability Insurance

transpotation & travel

Interest Expense (mortgage, biz creditcard)

Utilities (Do not include home office)

Maintenance and Repairs

water

Meals and Entertainment (Local)

electricity

Deductible with 50% limit

secuirty system

deductible with 100% limit

Phone & internet (business portion only)

civic club dues

others (please specify)

social or entertainment club due

Office supplies and expenses

If you have employees

office supplies

Wages paid to employees (Form W-2/W-3)

postage

Payroll taxes for employees (payroll tax returns)

software

Unemployment tax for employees

penalty and fines

Health insurance (employees only)

Professional Fees-(legal & other)

Employee benefit programs (other than wages)

Legal

Pension and Profit Sharing plans (employee part)

Tax preparation

Cost to set up pension plans

Supplies (other than inventory)

(Provide certificate and associated wages for WOC if any)

List equipment & assets acquired and/or placed in service during the year

purchase price or

Date acquired

Date placed in service

%

section 179

Description

adjusted basis

(MM/DD/YYYY)

(MM/DD/YYYY)

business use

expense

1

2

3

qualified leasehold

4

improvement (if any)

List assets disposed/sold or converted to personal use during the year

date acquired

cost

Date sold

selling or

selling

accumulated

description

(MM/DD/YYYY)

basis

(MM/DD/YYYY)

other price

expense

depreciation

1

2

3

4

Signature__________________

Date______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1