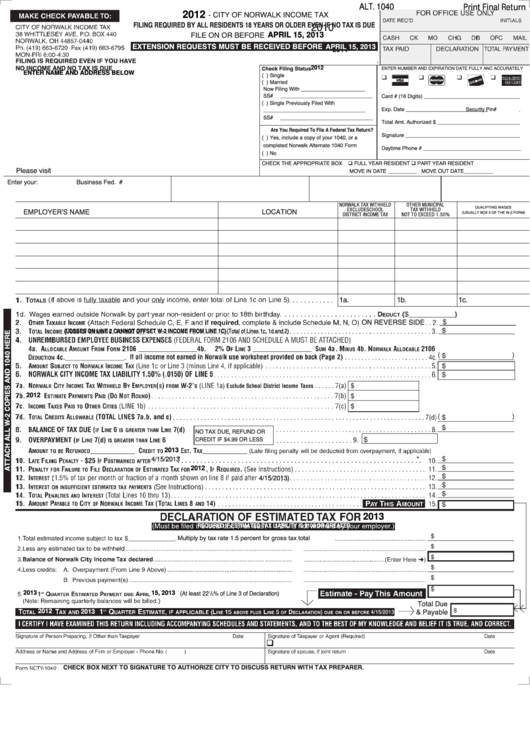

ALT. 1040

Print Final Return

2012

- CITY OF NORWALK INCOME TAX

FILING REQUIRED BY ALL RESIDENTS 18 YEARS OR OLDER EVEN IF NO TAX IS DUE

2010

FILE ON OR BEFORE

APRIL 15, 2013

EXTENSION REQUESTS MUST BE RECEIVED BEFORE

APRIL 15, 2013

2011

FILING IS REQUIRED EVEN IF YOU HAVE

NO INCOME AND NO TAX IS DUE

Check Filing Status

2012

ENTER NUMBER AND EXPIRATION DATE FULLY ANC ACCURATELY

ENTER NAME AND ADDRESS BELOW

( ) Single

( ) Married

Now Filing With ______________________

SS#_______________________________

Card # (16 Digits) __________________________________

( ) Single Previously Filed With

Exp. Date ____________________

Security Pin#

____________

___________________________________

SS#_______________________________

Total Amt. Authorized $ _____________________________

Are You Required To File A Federal Tax Return?

Signature ________________________________________

( ) Yes, include a copy of your 1040, or a

completed Norwalk Alternate 1040 Form

Daytime Phone # __________________________________

( ) No

CHECK THE APPROPRIATE BOX

FULL YEAR RESIDENT PART YEAR RESIDENT

Please visit for the On-Line Tax Preparation Tool.

MOVE IN DATE __________ MOVE OUT DATE__________

Enter your:

Business Fed. I.D. No.

Social Security No.

Spouse Security No.

Phone #

NORWALK TAX WITHHELD

OTHER MUNICIPAL

QUALIFYING WAGES

EXCLUDE SCHOOL

TAX WITHHELD

EMPLOYER’S NAME

LOCATION

(USUALLY BOX 5 OF THE W-2 FORM)

NOT TO EXCEED 1.50%

DISTRICT INCOME TAX

1a.

1b.

1c.

ON REVERSE SIDE

(LOSSES ON LINE 2 CANNOT OFFSET W-2 INCOME FROM LINE 1C) (Total of Lines 1c, 1d and 2)

2012

NO TAX DUE, REFUND OR

CREDIT IF $4.99 OR LESS

2013

*

*

4/15/2013

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2012

4/15/2013)

2013

REQUIRED IF ESTIMATED TAX LIABILITY IS $100 OR GREATER

Multiply by tax rate 1.5 percent for gross tax total................

...........

...........

...........

...........

2013

(At least 22

/

% of Line 3 of Declaration)

15, 2013

1

2

Total Due

2012

& Payable

2013

4/15/2013

CHECK BOX NEXT TO SIGNATURE TO AUTHORIZE CITY TO DISCUSS RETURN WITH TAX PREPARER.

1

1 2

2