Instructions For Form 8853 - Archer Msas And Long-Term Care Insurance Contracts - 2002

ADVERTISEMENT

02

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 8853

Archer MSAs and Long-Term Care Insurance Contracts

Section references are to the Internal Revenue Code unless otherwise noted.

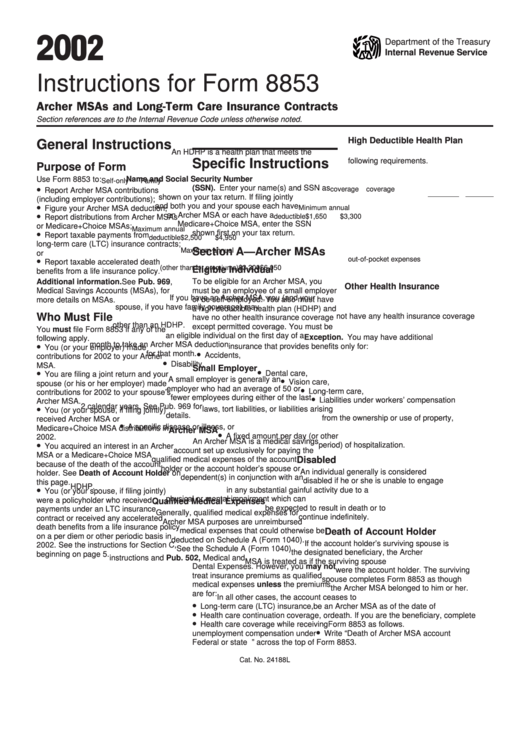

High Deductible Health Plan

General Instructions

An HDHP is a health plan that meets the

following requirements.

Specific Instructions

Purpose of Form

Use Form 8853 to:

Name and Social Security Number

Self-only

Family

•

(SSN). Enter your name(s) and SSN as

coverage

coverage

Report Archer MSA contributions

shown on your tax return. If filing jointly

(including employer contributions);

•

and both you and your spouse each have

Figure your Archer MSA deduction;

Minimum annual

•

an Archer MSA or each have a

deductible

$1,650

$3,300

Report distributions from Archer MSAs

Medicare+Choice MSA, enter the SSN

or Medicare+Choice MSAs;

Maximum annual

•

shown first on your tax return.

Report taxable payments from

deductible

$2,500

$4,950

long-term care (LTC) insurance contracts;

Section A—Archer MSAs

Maximum annual

or

•

out-of-pocket expenses

Report taxable accelerated death

(other than for premiums)

$3,300

$6,050

Eligible Individual

benefits from a life insurance policy.

To be eligible for an Archer MSA, you

Additional information. See Pub. 969,

Other Health Insurance

Medical Savings Accounts (MSAs), for

must be an employee of a small employer

If you have an Archer MSA, you (and your

or be self-employed. You also must have

more details on MSAs.

spouse, if you have family coverage) may

a high deductible health plan (HDHP) and

Who Must File

not have any health insurance coverage

have no other health insurance coverage

other than an HDHP.

except permitted coverage. You must be

You must file Form 8853 if any of the

an eligible individual on the first day of a

Exception. You may have additional

following apply.

•

month to take an Archer MSA deduction

insurance that provides benefits only for:

You (or your employer) made

•

for that month.

Accidents,

contributions for 2002 to your Archer

•

Disability,

MSA.

Small Employer

•

•

Dental care,

You are filing a joint return and your

•

A small employer is generally an

Vision care,

spouse (or his or her employer) made

•

employer who had an average of 50 or

Long-term care,

contributions for 2002 to your spouse’s

•

fewer employees during either of the last

Liabilities under workers’ compensation

Archer MSA.

•

2 calendar years. See Pub. 969 for

laws, tort liabilities, or liabilities arising

You (or your spouse, if filing jointly)

details.

from the ownership or use of property,

received Archer MSA or

•

A specific disease or illness, or

Medicare+Choice MSA distributions in

Archer MSA

•

A fixed amount per day (or other

2002.

An Archer MSA is a medical savings

•

period) of hospitalization.

You acquired an interest in an Archer

account set up exclusively for paying the

MSA or a Medicare+Choice MSA

Disabled

qualified medical expenses of the account

because of the death of the account

holder or the account holder’s spouse or

An individual generally is considered

holder. See Death of Account Holder on

dependent(s) in conjunction with an

disabled if he or she is unable to engage

this page.

HDHP.

•

in any substantial gainful activity due to a

You (or your spouse, if filing jointly)

physical or mental impairment which can

were a policyholder who received

Qualified Medical Expenses

be expected to result in death or to

payments under an LTC insurance

Generally, qualified medical expenses for

continue indefinitely.

contract or received any accelerated

Archer MSA purposes are unreimbursed

death benefits from a life insurance policy

medical expenses that could otherwise be

Death of Account Holder

on a per diem or other periodic basis in

deducted on Schedule A (Form 1040).

If the account holder’s surviving spouse is

2002. See the instructions for Section C,

See the Schedule A (Form 1040)

the designated beneficiary, the Archer

beginning on page 5.

instructions and Pub. 502, Medical and

MSA is treated as if the surviving spouse

Dental Expenses. However, you may not

were the account holder. The surviving

treat insurance premiums as qualified

spouse completes Form 8853 as though

medical expenses unless the premiums

the Archer MSA belonged to him or her.

are for:

In all other cases, the account ceases to

•

Long-term care (LTC) insurance,

be an Archer MSA as of the date of

•

Health care continuation coverage, or

death. If you are the beneficiary, complete

•

Health care coverage while receiving

Form 8853 as follows.

•

unemployment compensation under

Write “Death of Archer MSA account

Federal or state law.

holder” across the top of Form 8853.

Cat. No. 24188L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8