Form Ct-1120fc - Film Credits - Connecticut Department Of Revenue Services - 2007

ADVERTISEMENT

Department of Revenue Services

2007

Form CT-1120FC

State of Connecticut

(New 03/08)

Film Credits

For income year beginning: _______________________ , 2007 and ending: _______________________ , ________ .

Name of Eligible Taxpayer

Connecticut Tax Registration Number

Film Infrastructure Projects Tax Credit

General Information

Film infrastructure projects tax credit percentages range from 10%

Complete this form in blue or black ink only.

Use Form

of the investment made by the taxpayer for projects costing less

CT-1120FC to claim the business tax credits available for qualified

than $150,000; 15% of the investment made by the taxpayer for

film production, film infrastructure projects, and digital animation

projects costing more than $150,000 but less than $1,000,000;

production as provided in Conn. Gen. Stat. §12-217jj, as amended

and 20% of the investment made by the taxpayer for projects costing

by 2007 Conn. Pub. Acts 236, §1 and 2007 Conn. Pub. Acts 4 (June

more than $1,000,000. This credit may be applied against the

Spec. Sess.) §§69 and 70; 2007 Conn. Pub. Acts 236, §§ 2 and 3,

taxes imposed under Chapter 207 (insurance premiums and

as amended by 2007 Conn. Pub. Acts 7 (June Spec. Sess) §71.

health care centers taxes) or Chapter 208 (corporation business

The film production, film infrastructure, and digital animation

tax) of the Connecticut General Statutes.

production tax credits are administered by the Connecticut

Commission on Culture and Tourism (CCT). None of these three

Any film infrastructure projects tax credit not used in the income

tax credits may be claimed until CCT issues a tax credit voucher

year for which it is allowed may be carried forward for three

succeeding income years. Any film infrastructure tax credit

which lists the amount of the available tax credit.

allowed may be transferred; however, once transferred, film

Film Production Tax Credit

infrastructure tax credits may not be subsequently transferred.

The film production tax credit is equal to 30% of qualified

Digital Animation Production Tax Credit

production expenses and costs. Any tax credit not used in the

income year for which it is allowed may be carried forward for

State-certified digital animation production companies incurring

three succeeding income years.

expenses or costs in excess of $50,000 are eligible for a tax

credit equal to 30% of qualified production expenses and costs.

The initial legislation providing for the qualified film production

This credit may be applied against the taxes imposed under

tax credit was passed during the 2006 session of the Connecticut

Chapter 207 (insurance premiums and health care centers taxes)

General Assembly ["2006 legislation"] and is codified as Conn.

or Chapter 208 (corporation business tax) of the Connecticut

Gen. Stat. §12-217jj. The 2006 legislation was amended during

General Statutes.

the 2007 session and June 2007 special session of the

Any digital animation production tax credit not used in the income

Connecticut General Assembly ["2007 legislation"].

year for which it is allowed may be carried forward for three

Any film production tax credits governed by the 2006 legislation

succeeding income years. Alternatively, digital animation

must be claimed in the income year in which the credit voucher

production tax credits may be transferred, in whole or in part, no

was issued and may only be transferred by the production

more than three times.

company and may not be subsequently transferred. Film

production tax credits governed by the 2007 legislation must be

Additional Information

claimed for the income year in which the expenses were incurred

See Informational Publication 2006(15), Guide to Connecticut

and may be transferred, in whole or in part, no more than three

Business Tax Credits, or contact DRS, Taxpayer Services Division

times.

at 1-800-382-9463 (Connecticut calls outside the Greater

Hartford calling area only) or 860-297-5962 (from anywhere). TTY,

TDD, and Text Telephone users only may transmit inquiries

anytime by calling 860-297-4911.

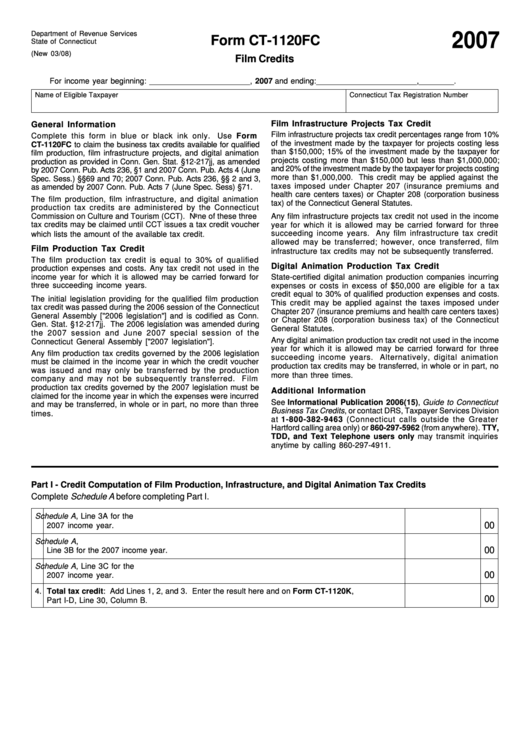

Part I - Credit Computation of Film Production, Infrastructure, and Digital Animation Tax Credits

Complete Schedule A before completing Part I.

1. Total amount of qualified Film Production Tax Credit as listed on Schedule A, Line 3A for the

00

2007 income year. ................................................................................................................................ 1.

2. Total amount of qualified Film Infrastructure Projects Tax Credit as listed on Schedule A,

00

Line 3B for the 2007 income year. ....................................................................................................... 2.

3. Total amount of qualified Digital Animation Tax Credit as listed on Schedule A, Line 3C for the

00

2007 income year. ................................................................................................................................ 3.

4. Total tax credit: Add Lines 1, 2, and 3. Enter the result here and on Form CT-1120K,

00

Part I-D, Line 30, Column B. ................................................................................................................ 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2