Form Ui-3 - Employers' Quarterly Wage Report

ADVERTISEMENT

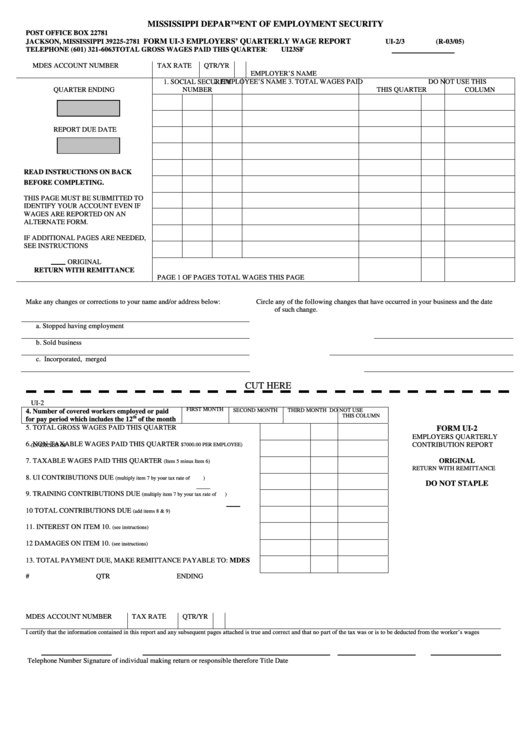

MISSISSIPPI DEPARTMENT OF EMPLOYMENT SECURITY

POST OFFICE BOX 22781

FORM UI-3 EMPLOYERS’ QUARTERLY WAGE REPORT

JACKSON, MISSISSIPPI 39225-2781

UI-2/3 (R-03/05)

TELEPHONE (601) 321-6063

TOTAL GROSS WAGES PAID THIS QUARTER:

UI23SF

MDES ACCOUNT NUMBER

TAX RATE

QTR/YR

EMPLOYER’S NAME

1. SOCIAL SECURITY

2. EMPLOYEE’S NAME

3. TOTAL WAGES PAID

DO NOT USE THIS

QUARTER ENDING

NUMBER

THIS QUARTER

COLUMN

REPORT DUE DATE

READ INSTRUCTIONS ON BACK

BEFORE COMPLETING.

THIS PAGE MUST BE SUBMITTED TO

IDENTIFY YOUR ACCOUNT EVEN IF

WAGES ARE REPORTED ON AN

ALTERNATE FORM.

IF ADDITIONAL PAGES ARE NEEDED,

SEE INSTRUCTIONS

ORIGINAL

RETURN WITH REMITTANCE

PAGE 1 OF

PAGES

TOTAL WAGES THIS PAGE

Make any changes or corrections to your name and/or address below:

Circle any of the following changes that have occurred in your business and the date

of such change.

a. Stopped having employment

b. Sold business

c. Incorporated, merged

CUT HERE

UI-2

FIRST MONTH

SECOND MONTH

THIRD MONTH

DO NOT USE

4. Number of covered workers employed or paid

THIS COLUMN

th

for pay period which includes the 12

of the month

FORM UI-2

5.

TOTAL GROSS WAGES PAID THIS QUARTER

EMPLOYERS QUARTERLY

CONTRIBUTION REPORT

(IN EXCESS OF

6.

NON-TAXABLE WAGES PAID THIS QUARTER

$7000.00 PER EMPLOYEE)

ORIGINAL

RETURN WITH REMITTANCE

7.

TAXABLE WAGES PAID THIS QUARTER

(Item 5 minus Item 6)

DO NOT STAPLE

8.

UI CONTRIBUTIONS DUE

(multiply item 7 by your tax rate of

)

9.

TRAINING CONTRIBUTIONS DUE

(multiply item 7 by your tax rate of

)

10

TOTAL CONTRIBUTIONS DUE

(add items 8 & 9)

11. INTEREST ON ITEM 10.

(see instructions)

12

DAMAGES ON ITEM 10.

(see instructions)

13. TOTAL PAYMENT DUE, MAKE REMITTANCE PAYABLE TO: MDES

F.I.D. #

QTR ENDING

MDES ACCOUNT NUMBER

TAX RATE

QTR/YR

I certify that the information contained in this report and any subsequent pages attached is true and correct and that no part of the tax was or is to be deducted from the worker’s wages

Telephone Number

Signature of individual making return or responsible therefore

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1